Effortless BOI Reporting that Transforms Deadlines into Revenue Milestones

PathQuest BOI is a purpose-driven platform that helps businesses seamlessly navigate beneficiary ownership reporting before critical deadlines

The Corporate Transparency Act (CTA), effective January 1, 2024, mandates that over 33 million businesses report Beneficial Ownership Information (BOI) by January 1, 2025, to enhance transparency and combat financial crimes. PathQuest BOI offers a unique blend of software and services that simplifies compliance, saves time, and unlocks lucrative revenue opportunities while helping businesses avoid strict penalties for non-compliance.

Opportunity, Revenue, Growth

Do you want to turn filing your clients’ BOI reports into a new revenue stream?

Are you interested in multiplying revenue without adding overheads?

Are you looking to eliminate sleepless nights while keeping the revenue flowing?

Are you aiming to become the go-to compliance expert for your clients?

Do you wish grow your business at speed and scale?

Are you interested in multiplying revenue without adding overheads?

PathQuest BOI: Your Trusted BOI Reporting Solution

PathQuest BOI for Owners

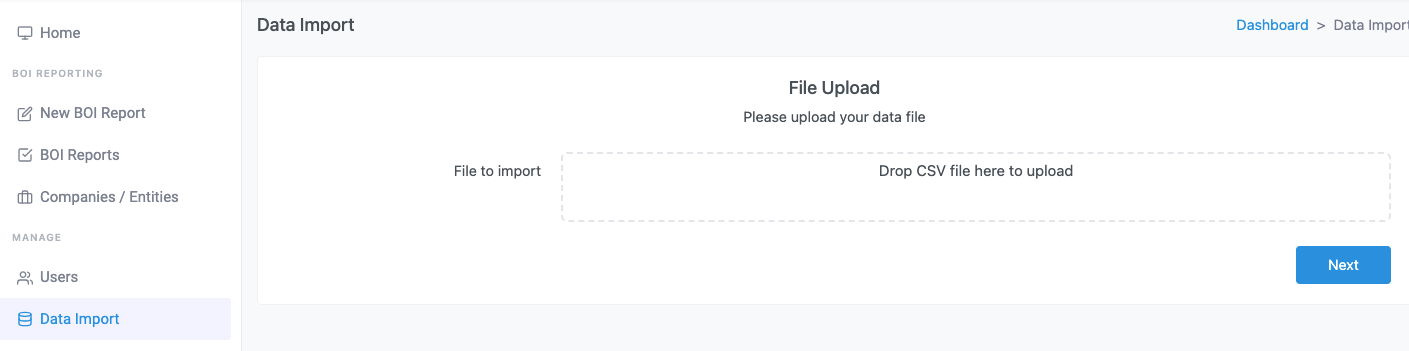

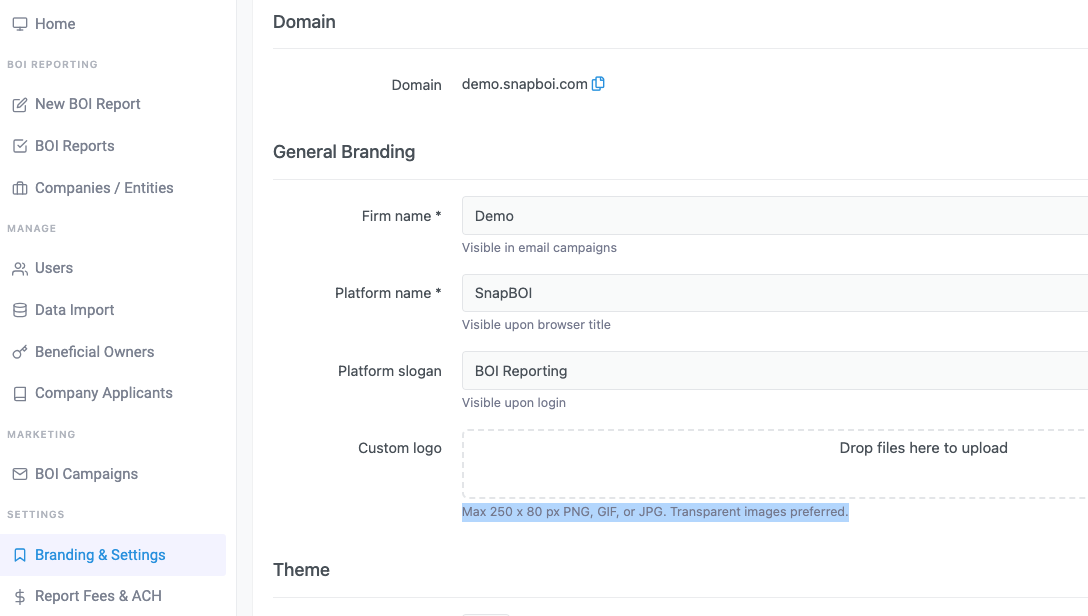

Discover how to seamlessly file BOI information for your clients with a custom-branded landing page tailored to your firm. Unlock new revenue streams by strategically pricing your reports and effortlessly importing client data into the platform for efficient processing. Learn how to market PathQuest BOI to empower clients with its full potential.

PathQuest BOI for Filers

Learn how Beneficial Owners can streamline BOI filing. After completing PathQuest BOI registration with your CPA’s guidance, simply update company details, add applicant information (if formed post-January 2024), and declare Beneficial Owners with photo ID. Finalise payment, then submit for CPA review, making compliance effortless.

PathQuest BOI: Full-service and Do It Yourself

Discover our full-service package that simplifies BOI filing. Just provide data from your tax, law, or accounting software, and our expert onboarding enables you to manage clients independently. If you prefer to do it yourself, we provide an onboarding session to guide your team in creating a fully branded webpage and updating FAQs, disclaimers, and support details to ensure clients have everything they need.

Service Offerings

Explore our tiered service offerings to find the ideal solution for your business goals. From essential tools to premium features, we have the right fit for you.

PathQuest BOI Pro

- Personalized client portal with your logo and brand colors.

- Easy filing process with an intuitive, user-friendly interface.

- Seamless client management and interactions through a dedicated platform.

- Enterprise-grade data security to protect your information.

- Smooth integration with your existing systems and workflows.

- Assistance via chat and email for any needs.

- Scalable Software + Service model for BOI reporting with comprehensive compliance

- Let us do all the work

- Easy, fast, and profitable without extra staffing

- Unlimited live support

PathQuest BOI Basic

- Personalized client portal with your logo and brand colors.

- Easy filing process with an intuitive, user-friendly interface.

- Seamless client management and interactions through a dedicated platform.

- Enterprise-grade data security to protect your information.

- Smooth integration with your existing systems and workflows.

- Assistance via chat and email for any needs.

Intuit Special Pricing

-

Fee Per Initial Filling

$199

$175

-

Fee Per Corrected/Updated Filing

$67

$67

-

Suggested Partner Fee to Client

$500

$500

-

Fee Per Initial Filling

$97

$75

-

Fee Per Corrected/Updated Filing

$67

$67

-

Suggested Partner Fee to Client

$500

$500

FAQs

Yes. Reporting companies created or registered in 2024 must report their beneficial ownership information to FinCEN within 90 days of receiving actual or public notice of creation or registration. Reporting companies created or registered in 2025 or later must report their beneficial ownership information to FinCEN within 30 days of receiving actual or public notice of creation or registration.

These obligations remain applicable to reporting companies that cease to exist as legal entities—meaning wound up their affairs, ceased conducting business, and entirely completed the process of formally and irrevocably dissolving—before their initial beneficial ownership reports are due. If a reporting company files an initial beneficial ownership information report and then ceases to exist, then there is no requirement for the reporting company to file an additional report with FinCEN noting that the company has ceased to exist.

Yes. Beneficial ownership information reporting requirements apply to all companies that qualify as “reporting companies”, regardless of when they were created or registered. Companies are not required to report beneficial ownership information to FinCEN if they are exempt or ceased to exist as legal entities before January 1, 2024.

A company is not required to report its beneficial ownership information to FinCEN if it ceased to exist as a legal entity before January 1, 2024, meaning that it entirely completed the process of formally and irrevocably dissolving. A company that ceased to exist as a legal entity before the beneficial ownership information reporting requirements became effective January 1, 2024, was never subject to the reporting requirements and thus is not required to report its beneficial ownership information to FinCEN.

If a reporting company continued to exist as a legal entity for any period of time on or after January 1, 2024 (i.e., did not entirely complete the process of formally and irrevocably dissolving before January 1, 2024), then it is required to report its beneficial ownership information to FinCEN, even if the company had wound up its affairs and ceased conducting business before January 1, 2024.

The Corporate Transparency Act (CTA), enacted in 2021, was passed to enhance transparency in entity structures and ownership to combat money laundering, tax fraud, and other illicit activities. It is designed to capture more information about the ownership of specific entities operating in or accessing the U.S. market.

Specifically, for purposes of the CTA, a “Reporting Company”

is:

(a) any company that is created by filing a document

with

a governmental agency (including a federally recognized

Indian

Tribe), such as a corporation, a limited liability company,

or a

limited partnership;

or

(b) a foreign-formed entity

that

is registered or registers to do business in the United

States.

Although the CTA includes twenty-three categories of

businesses that are exempt from the CTA, these exempt

businesses

generally are already extensively regulated by the federal

government or a state government. Also exempt from the CTA,

for

example, are sole proprietorships and general partnerships,

because they are not formed by filing a document with a

state

governmental agency.

The beneficial ownership information (BOI) reporting is a key requirement under the Corporate Transparency Act (CTA), enacted in 2021. The CTA establishes uniform reporting standards for business entities. By requiring disclosure of personal details about who owns or controls a company, the BOI report aims to help identify and prevent illegal activities such as tax fraud, money laundering, drug trafficking, and the financing of terrorism.

A beneficial ownership information (BOI) report is a document submitted to the Financial Crimes Enforcement Network (FinCEN) that details registered business entities, their beneficial owners (individuals with significant control or at least 25% ownership), and their company applicants, if the entity was formed on, or after, January 1, 2024.

In 2021, bipartisan efforts in Congress resulted in the enactment of the Corporate Transparency Act. This law imposes a new requirement for companies to disclose beneficial ownership information. The objective is to bolster the U.S. government's efforts to thwart the ability of wrongdoers to conceal or profit from illicit gains through shell companies or intricate ownership arrangements. The Corporate Transparency Act seeks to establish a confidential repository that federal authorities can utilize to identify all individuals associated with a reporting company.

Any individual who owns or controls at least 25% of the

ownership interests in a reporting company is considered a

beneficial owner.

An ownership interest can include:

- Equity

- Stock

- Capital or profit interest

- Voting rights

- Any instrument convertible into stock, equity, voting rights, or capital or profit interest

- Options or other non-binding privileges to buy or sell any of the interests mentioned above

- Any other contract, instrument, or mechanism to establish ownership

Beneficial ownership refers to individuals who either directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25% of a reporting company's ownership interest.

The Corporate Transparency Act mandates the disclosure of personal details concerning individuals with direct or indirect ownership or control over a company. These disclosures are termed Beneficial Ownership Information reports.

Reporting companies that were established or registered for business before January 1, 2024, have until January 1, 2025, to submit their initial BOI report.

Reporting companies formed or registered between January 1, 2024, and January 1, 2025, have 90 calendar days after receiving actual or public notice that their company's creation or registration is effective, to file their initial BOI reports.

Reporting companies created or registered on or after

January 1, 2025, must file their initial reports within 30

calendar days from the actual creation or registration date

or from the date of public notice.

Example #1: ABC Company

(formed/registered in April 1999); does not qualify for an

exemption.

Filing deadline: before January 1, 2025.

Example #2: NY Corp (formed/registered

January 10, 2024); does not qualify for an exemption.

Filing deadline: 90 days from receiving notice of the

company’s effective registration.

Additionally, companies must submit updated reports if there are any changes regarding the company or its beneficial owners. These updated reports are due within 30 days of any changes.

The following are some examples of changes that would require an updated BOI report:

- If a reporting company changes its name, including a new DBA or Trade Name.

- If there’s a change in beneficial owners – such as the company hired a new CEO, or an existing owner reaches the 25% ownership threshold and is now considered to be a beneficial owner.

- Death of a beneficial owner – when the deceased beneficial owner’s estate is settled.

- If there’s any change to the existing beneficial owners identifying information – such as change of name, address, or unique identifier and/or if a beneficial owner is issued a new driver’s license or identifying document that has updated information.

- A new report must be filed if a minor child, under the special reporting rule, was omitted from a previously filed BOI report, turns 18 a new BOI report must be filed.

Filing deadline: 30 days from when the new CFO was hired.

Example 2: : ABC, Inc (formed/registered in March 2024); John, a beneficial owner, was 15 at the time and therefore omitted from the initial report under the special reporting rule. He turns 18 on June 14, 2026.

Filing deadline: 30 days from his 18th birthday.

Both individuals and corporate entities can be held liable for willful violations. This can include an individual who actually files (or attempts to file) false information with FinCEN, as well as anyone who willfully provides false information to the filer of the report.

These individuals can be subject to the same civil and criminal penalties as the reporting company.

FinCEN will implement access to beneficial ownership information in phases:

- The first phase, anticipated to commence in the spring of 2024, will involve a pilot program for select Federal agency users.

- The second phase, expected in the summer of 2024, will expand access to Treasury offices and other Federal agencies involved in law enforcement and national security, with existing memoranda of understanding for access to Bank Secrecy Act information.

- The third phase, projected for the fall of 2024, will broaden access to additional Federal agencies engaged in law enforcement, national security, and intelligence activities, as well as to State, local, and Tribal law enforcement partners.

- The fourth phase, anticipated in the winter of 2024, will extend access to intermediary Federal agencies in response to foreign government requests.

- • The fifth phase, expected in the spring of 2025, will grant access to financial institutions subject to customer due diligence requirements under applicable laws and their supervisory bodies.

At present, FinCEN is not accepting requests for access to beneficial ownership information.

However, it will offer further guidance on accessing this information in the future.

Under the Corporate Transparency Act, various entities, including federal, state, local, Tribal officials, as well as certain foreign officials, making requests through a U.S. federal agency, have the authority to access beneficial ownership information. This database is not accessible to private citizens and is not considered public information.

Access is granted for purposes aligned with national security, intelligence, and law enforcement. Financial institutions may also access such information, under specific circumstances, provided there is consent from the reporting company. Additionally, regulatory bodies overseeing these financial institutions will have access during their supervisory processes.

FinCEN is currently developing regulations to govern the access and management of beneficial ownership information. All reported data will be securely stored in a non-public database, employing robust information security measures consistent with those utilized in the federal government, to safeguard sensitive yet unclassified information systems at the highest security levels.

FinCEN will work closely with authorized entities to ensure they understand their roles and responsibilities, ensuring that the information is utilized solely for authorized purposes and handled in a manner that prioritizes security and confidentiality.

State, local, and Tribal law enforcement agencies—government bodies authorized by law to investigate or enforce civil or criminal violations—may request beneficial ownership information from FinCEN under specific circumstances. However, a state, local, or Tribal law enforcement agency can only make such a request if authorized by a "court of competent jurisdiction" to obtain the information for a criminal or civil investigation. Additionally, the agency must fulfill certain access criteria, including entering into an MOU with FinCEN outlining how it will safeguard the security and confidentiality of the information.

Moreover, state regulatory agencies overseeing financial institutions' compliance with customer due diligence requirements may seek beneficial ownership information from FinCEN for regulatory purposes. Like other domestic government agencies, state regulatory bodies must also establish an MOU with FinCEN describing their commitment to protecting the security and confidentiality of the information in order to access beneficial ownership data.

Yes. A corporation treated as a pass-through entity under Subchapter S of the Internal Revenue Code (an "S Corporation" or "S-Corp") that qualifies as a reporting company—i.e., that is created or registered to do business by filing a document with a secretary of state or a similar office and does not qualify for any exemptions to the reporting requirements—must comply with the reporting requirements. The S-Corp’s pass-through tax structure does not affect its BOI reporting obligations. Specifically, pass-through treatment under Subchapter S does not qualify an S-Corp as a "tax-exempt entity" under FinCEN BOI reporting regulations.

No. According to FinCEN's BOI reporting regulations, a domestic reporting company generally includes a corporation or limited liability company (LLC) created by filing a document with a secretary of state or a similar office. If, in a rare case, a domestic corporation or LLC is established without such a filing, it is not considered a reporting company.

It depends. Homeowners’ associations (HOAs) can take various corporate forms. If an HOA was not created by filing a document with a secretary of state or similar office, it is not considered a domestic reporting company under CTA. An HOA that was incorporated or created through such a filing might be eligible for an exemption from the reporting requirements. For instance, HOAs designated as 501(c)(4) social welfare organizations may qualify for the tax-exempt entity exemption. However, an incorporated HOA that is not designated as a 501(c)(4) organization may fall under the definition of a reporting company and be required to report BOI to FinCEN.

Although FinCEN provides some guidance regarding trusts, it is a complex issue. Reporting companies owned by multiple trusts or trusts with multiple individuals with varying degrees of control can raise particularly difficult issues for those responsible for CTA compliance.

It is advisable to keep abreast of any further guidance provided by FinCEN and may be advisable to obtain legal advice to determine the compliance obligations of the trust and the individuals who may be beneficial owners of a reporting company.

For purposes of reporting beneficial ownership information to FinCEN, “Indian Tribe” means any Indian or Alaska Native tribe, band, nation, pueblo, village, or community that the Secretary of the Interior acknowledges to exist as an Indian tribe. The Secretary of the Interior is required to publish annually a list of all recognized Indian Tribes in the Federal Register

Foreign governments cannot directly access the beneficial ownership IT system—the secure system used by FinCEN to receive and store BOI data. However, they can request such information through intermediary Federal agencies. Foreign governments may seek beneficial ownership details for law enforcement investigations or prosecutions, or for national security or intelligence activities, provided these actions are authorized under the foreign country's laws.

There are two avenues for foreign governments to make requests:

- Through an international treaty, agreement, or convention.

- In cases where no such treaty, agreement, or convention exists, requests may be made by a law enforcement, judicial, or prosecutorial authority of a foreign country that FinCEN, with the concurrence of the Secretary of State and in consultation with the Attorney General or other relevant agencies, determines to be a trusted foreign country.

However, FinCEN is not currently processing foreign requests for beneficial ownership information.

A BOI Report need only be submitted once, but once filed, it must be updated within 30 days of any change or correction of the information last reported.

For example, if there is a change in ownership of the reporting company, an updated BOI report must be filed within 30 days to report the new beneficial owners. Similarly, if the residential address of a beneficial owner changes, the new address must be reported on an updated BOI report within 30 days of the change in residence.

Yes. When filing a report on the BOI platform, the initial step will prompt the user to indicate if the filing is an Initial, Correced, or Updated filing.

The BOI platform accepts credit card as the method of payment.

This BOI platform provides a safe, secure and easy method of creating and filing your BOI report.

Your trusted advisor and BOI support are able to answer questions and assist you.

As you create your BOI report, your progress is saved, thus, you are able to easily return to complete an Initial BOI report, Updated or Corrected report, without entering information multiple times.

Your filing on this BOI platform is also protected by a $10,000 warranty for each filing (assuming your filing is accurate and timely).

Other than being unnecessary and reducing privacy, there is no real downside.

Discovering an inaccuracy in a beneficial ownership information report requires prompt correction. Follow these steps:

- Identify the Inaccuracy: Once aware or having reason to know of any inaccuracies in the report concerning your company, its beneficial owners, or its company applicants, initiate the correction process.

- Timely Correction: Your company must rectify the inaccuracies within 30 days from the date of awareness or having reason to know about the inaccuracy. This ensures compliance with reporting standards.

Maintain accuracy in your beneficial ownership information report by promptly addressing any discrepancies.

The beneficial ownership information collected by FinCEN is not made public and is only available to certain government agencies and used for law enforcement, national security, and intelligence purposes, as well as financial institutions so they can fulfill certain reporting obligations, regulatory agencies that supervise financial institutions, and the Department of Treasury.

For companies existing before January 1, 2024, the initial Beneficial Ownership Information Report must be filed by January 1, 2025. For companies created or registered between January 1, 2024 and January 1, 2025, the report must be filed within 90 calendar days of receiving notice of effective creation or registration. For companies created or registered on or after January 1, 2025, the report must be filed within 30 calendar days of receiving notice of effective creation or registration.

Failure to meet these deadlines may result in FinCEN penalties.

Anyone authorized to act on behalf of an individual may request a FinCEN identifier on the individual’s behalf on or after January 1, 2024.

FinCEN identifiers for individuals are provided upon request after the requesting party has submitted the necessary information. Obtaining a FinCEN identifier for an individual requires the requesting party to create a Login.gov account, which is tied to the individual receiving the FinCEN identifier. Individuals who receive a FinCEN identifier should secure their login credentials, including email address and related multi-factor information

No. The CTA requires that all BOI reports are submitted to FinCEN. When forming or registering a business with your Secretary of State or similar office, you are not required to file this BOI report.

No, an initial BOI report should only include beneficial owners as of the filing date; historical beneficial owners need not be included. Reporting companies must promptly notify FinCEN of changes to beneficial owners through updated reports within 30 days of any change.

To obtain an Employer Identification Number (EIN) or taxpayer identification number (TIN), within 30 days for timely BOI reporting, the IRS offers a free online application at www.irs.gov. Foreign entities can request an EIN through a paper filing process which takes approximately 8 weeks. These filings should be completed shortly after formation to meet the 90-day requirement for new entities formed in 2024.

Reporting companies not subject to U.S. corporate income tax may report a foreign tax identification number and the relevant jurisdiction’s name in place of an EIN or TIN.

No, each Reporting Company within a group must independently file its own BOI report. A parent company cannot file a single report on behalf of its subsidiaries.

In the case of every trust, it must be determined if the trust is a reporting company. If so, the trust must file its initial BOI report by January 1, 2025, if it was created (if domestic) or registered to do business (if foreign) before January 1, 2024.

Trusts that are reporting companies that are created or registered for the first time in the US during 2024 must file within 90 calendar days of first receiving actual or public notice of their creation or registration. That deadline drops to 30 calendar days for reporting companies created or registering for the first time in 2025 and beyond.

Trusts that are reporting companies also have to file updated BOI reports within 30 calendar days of a change in the information the reporting company reported about the reporting company or its beneficial owners.

Yes, if the entity meets the reporting company definition and does not qualify for any exemptions to the reporting requirements.

While Indian Tribes have varying legal entity formation practices, some allow individuals to form legal entities such as corporations or LLCs under Tribal law by the filing of a document (such as Articles of Incorporation) with a Tribal office or agency whose routine functions include creating such entities pursuant to such filings. Tribal offices or agencies that perform this function may be called something other than a “secretary of state,” but they are performing a function similar to that of a typical secretary of state’s office. As a result, a legal entity created by a filing with such Tribal office or agency is a reporting company and is required to file beneficial ownership information with FinCEN, unless it qualifies for an exemption..

Note that, under the Corporate Transparency Act, a legal entity is a reporting company only if it is created or registered to do business “under the laws of a State or Indian Tribe.” Tribal corporations formed under federal law through the issuance of a charter of incorporation by the Secretary of the Interior—such as those created under section 3 of the Oklahoma Indian Welfare Act (25 U.S.C. 5203), or section 17 of the Indian Reorganization Act of 1934 (25 U.S.C. 5124)—are not created by the filing of a document with a secretary of state or similar office under the laws of an Indian tribe, and are therefore not reporting companies required to report beneficial ownership information to FinCEN.

Note also that “governmental authorities” are not required to report beneficial ownership information to FinCEN. For this purpose, a “governmental authority” is an entity that is (1) established under the laws of the United States, an Indian Tribe, a State, or a political subdivision of a State, or under an interstate compact between two or more States, and that (2) exercises governmental authority on behalf of the United States or any such Indian Tribe, State, or political subdivision. Thus, a Tribal entity that is such a “governmental authority” is not required to report beneficial ownership information to FinCEN. This category includes tribally chartered corporations and state-chartered Tribal entities, if those corporations or entities exercise governmental authority on a Tribe’s behalf.

Certain subsidiaries of governmental authorities are also exempt from the requirement to report beneficial ownership information to FinCEN. An entity qualifies for this exemption if its ownership interests are controlled (in their entirety) or wholly owned, directly or indirectly, by a governmental authority. Thus, for example, if a tribally chartered corporation (or state-chartered Tribal entity) exercises governmental authority on a Tribe’s behalf, and that tribally chartered corporation (or state-chartered Tribal entity) controls or wholly owns the ownership interests of another entity, then both the tribally chartered corporation (or state-chartered Tribal entity) and that subsidiary entity are exempt from the requirement to report beneficial ownership information to FinCEN.

Other exemptions to the reporting requirements, such as the exemption for “tax-exempt entities,” may also apply to certain entities formed under Tribal law.

The answer depends in part on the nature of the entity owned by the Indian Tribe. This informs the determination on whether the entity is a reporting company that must report beneficial ownership information.

In general, a reporting company must report as beneficial owners all individuals who, directly or indirectly, exercise substantial control over the reporting company, and any individuals who directly or indirectly own or control at least 25 percent or more of the reporting company’s ownership interests.

An Indian Tribe is not an individual, and thus should not be reported as an entity’s beneficial owner, even if it exercises substantial control over an entity or owns or controls 25 percent or more of the entity’s ownership interests. However, entities in which Tribes have ownership interests may still have to report one or more individuals as beneficial owners in certain circumstances.

Entity Is a Tribal Governmental Authority. An entity is not a reporting company—and thus does not need to report beneficial ownership information at all—if it is a “governmental authority,” meaning an entity that is (1) established under the laws of the United States, an Indian Tribe, a State, or a political subdivision of a State, or under an interstate compact between two or more States, and that (2) exercises governmental authority on behalf of the United States or any such Indian Tribe, State, or political subdivision. This category includes tribally chartered corporations and state-chartered Tribal entities if those corporations or entities exercise governmental authority on a Tribe’s behalf.

Entity’s Ownership Interests Are Controlled or Wholly Owned by a Tribal Governmental Authority. A subsidiary of a Tribal governmental authority is likewise exempt from BOI reporting requirements if its ownership interests are entirely controlled or wholly owned by the Tribal governmental authority.

Entity Is Partially Owned by a Tribe (and Is Not Exempt). A non-exempt entity partially owned by an Indian Tribe should report as beneficial owners all individuals exercising substantial control over it, including individuals who are exercising substantial control on behalf of an Indian Tribe or its governmental authority. The entity should also report any individuals who directly or indirectly own or control at least 25 percent or more of ownership interests of the reporting company. (However, if any of these individuals owns or controls these ownership interests exclusively through an exempt entity or a combination of exempt entities, then the reporting company may report the name(s) of the exempt entity or entities in lieu of the individual beneficial owner.)

Your company may need to report information about its beneficial owners if it is:

- A corporation, a limited liability company (LLC), or was otherwise created in the United States by filing a document with a secretary of state or any similar office under the law of a state or Indian tribe; or

- A foreign company and was registered to do business in any U.S. state or Indian tribe by such a filing.

Companies required to report are called reporting companies. Reporting companies may have to obtain information from their beneficial owners and report that information to FinCEN.

Once a Beneficial Owner is created and assigned to at least one reporting company, the Beneficial Owner may then be selected for any number of additional entities - with no duplicate data entry required.

No, reporting companies must identify ALL individuals who meet the definition of a beneficial owner and do not qualify as an exception to the reporting rule.

A beneficial owner is an individual who either directly or indirectly:

- Exercises substantial control over a reporting company, or

- Owns or controls at least 25 percent of a reporting company’s ownership interests.

Since beneficial owners must be individuals (i.e., natural persons) — trusts, corporations, or other legal entities do not qualify as beneficial owners.

However, in certain situations, information about an entity may be reported instead of information about a beneficial owner.

A beneficial owner is an individual who, directly or indirectly:

- Exercises Substantial Control: This means having the authority to make significant decisions for the reporting company, regardless of actual ownership. Some examples include senior officers such as CEOs and COOs, those with the power to appoint board members, or individuals who direct, or enter into important contracts.

- Owns or Controls at least 25% Ownership Interests: Any individual holding 25% or more ownership interests, be it in the form of shares, membership in an LLC, or convertible notes, is considered a beneficial owner. This calculation is per individual, including indirect ownership through entities like LLCs.

An individual qualifies as a Beneficial Owner if they play a significant role in decisions regarding:

- Business operations

- Financial matters

- Organizational structure

- Any individual influencing these key decisions is considered to exercise substantial control over the reporting company.

Ownership Interest encompasses various forms of agreements indicating ownership rights within the reporting company. This includes equity shares, voting rights, or any mechanism signifying ownership. When assessing the 25% ownership threshold, all forms of ownership must be considered.

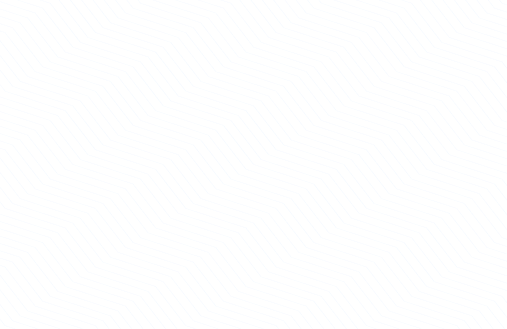

For each individual categorized as a Beneficial Owner, a Reporting Company must furnish:

- The individual’s name

- Date of birth

- Primary residential street address

- An identifying number from an acceptable identification document, such as a passport or U.S. driver’s license, along with the issuing state’s name or jurisdiction of the identification document and an image of the identification document used to obtain the identifying number.

Whether an individual has "substantial control" over a reporting company depends on the power they may exercise over a reporting company. For example, an individual will have substantial control over a reporting company if they direct, determine or exercise substantial influence over, important decisions the reporting company makes. In addition, any senior officer is deemed to have substantial control over a reporting company. Other rights or responsibilities may also constitute substantial control.

Substantial control can be established through four main avenues:

- Senior officer status: holding senior positions like President, CFO, or CEO.

- Authority in appointing or removing Officers or Directors.

- Key decision-making role in pivotal decisions regarding the company's operations, finances, or organizational structure.

- Other forms of control that significantly influence the reporting entity.

Submit the current residential address, ensuring that it is updated within 30 days of any changes or updates to previously reported information.

The unaffiliated company itself cannot be a beneficial owner, as it must be an individual. However, individuals exerting substantial control through the unaffiliated company must be reported as beneficial owners. Those lacking influence over important decisions may not qualify as a Beneficial Owner.

For purposes of this question, “corporate trustee” means a legal entity rather than an individual exercising the powers of a trustee in a trust arrangement.

If a reporting company’s ownership interests are owned or controlled through a trust arrangement with a corporate trustee, the reporting company should determine whether any of the corporate trustee’s individual beneficial owners indirectly own or control at least 25 percent of the ownership interests of the reporting company through their ownership interests in the corporate trustee.

- For example, if an individual owns 60 percent of the corporate trustee of a trust, and that trust holds 50 percent of a reporting company’s ownership interests, then the individual owns or controls 30 percent (60 percent × 50 percent = 30 percent) of the reporting company’s ownership interests and is therefore a beneficial owner of the reporting company.

- By contrast, if the same trust only holds 30 percent of the reporting company’s ownership interests, the same individual corporate trustee owner only owns or controls 18 percent (60 percent × 30 percent = 18 percent) of the reporting company, and thus is not a beneficial owner of the reporting company by virtue of ownership or control of ownership interests.

The reporting company may, but is not required to, report the name of the corporate trustee in lieu of information about an individual beneficial owner only if all of the following three conditions are met:

- The corporate trustee is an entity that is exempt from the reporting requirements.

- The individual beneficial owner owns or controls at least 25 percent of ownership interests in the reporting company only by virtue of ownership interests in the corporate trustee.and

- The individual beneficial owner does not exercise substantial control over the reporting company.

In addition to considering whether the beneficial owners of a corporate trustee own or control the ownership interests of a reporting company whose ownership interests are held in trust, it may be necessary to consider whether any owners of, or individuals employed or engaged by, the corporate trustee exercise substantial control over a reporting company. The factors for determining substantial control by an individual connected with a corporate trustee are the same as for any beneficial owner.

A beneficial owner is any individual who either:

- Exercises substantial control over a reporting company, or

- Owns or controls at least 25 percent of a reporting company’s ownership interests. Exercising substantial control or owning or controlling ownership interests may be direct or indirect, including through any contract, arrangement, understanding, relationship, or otherwise.

Trust arrangements vary. Particular facts and circumstances determine whether specific trustees, beneficiaries, grantors, settlors, and other individuals with roles in a particular trust are beneficial owners of a reporting company whose ownership interests are held through that trust.

For instance, the trustee of a trust may be a beneficial owner of a reporting company either by exercising substantial control over the reporting company, or by owning or controlling at least 25 percent of the ownership interests in that company through a trust or similar arrangement. Certain beneficiaries and grantors or settlors may also own or control ownership interests in a reporting company through a trust. The following conditions indicate that an individual owns or controls ownership interests in a reporting company through a trust:

- A trustee (or any other individual) has the authority to dispose of trust assets.

- A beneficiary is the sole permissible recipient of income and principal from the trust or has the right to demand a distribution of or withdraw substantially all of the assets from the trust.or

- A grantor or settlor has the right to revoke the trust or otherwise withdraw the assets of the trust.

This may not be an exhaustive list of the conditions under which an individual owns or controls ownership interests in a reporting company through a trust. Because facts and circumstances vary, there may be other arrangements under which individuals associated with a trust may be beneficial owners of any reporting company in which that trust holds interests.

The reporting status of these type of entities depends on their type, and method of establishment:

A domestic entity, such as a statutory trust, business trust, or foundation, is classified as a reporting company only if its formation involves filing documentation with a secretary of state or similar office.

Similarly, a foreign entity achieves reporting status if it registers to conduct business in the United States by filing with a secretary of state or equivalent office.

State laws vary as to whether certain entity types, such as trusts, require a filing with the secretary of state or similar office for formation or registration.

Entities must also determine whether an exemption applies. For example, a foundation may be exempt from reporting beneficial ownership information if it qualifies for the tax-exempt entity exemption.

Utilize the Exemption tool to determine if your business qualifies for any exemptions.

Yes, a beneficial owner can also be a company applicant. Keep in mind, that if the same person is a beneficial owner and company applicant, both roles must be reported.

Companies required to submit beneficial ownership information (BOI) reports are termed "reporting companies". Unless specifically exempt, your company will fall under this category. This includes, but is not limited to, LLCs, corporations, partnerships, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

Several filing exemptions do exist, with the most common being the "large operating company" exemption. This particular exemption mandates that your business must have both, 20 or more full-time employees and over $5 million in U.S. sourced revenue, as reported on its last business tax return, to qualify. Other exemptions are rarer, and primarily apply to highly regulated entities.

Determine your filing requirement by utilizing the Exemption tool and see if you qualify for any of the 23 available exemptions.

Yes, if a company is established or registered to operate in a U.S. territory and does not meet the criteria for an exemption, it must disclose beneficial ownership information to FinCEN. U.S. territories include Puerto Rico, the Northern Mariana Islands, American Samoa, Guam, and the U.S. Virgin Islands.

The status of being a beneficial owner depends on the circumstances. While a reporting company’s “partnership representative” or “tax matters partner” isn't automatically considered a beneficial owner, they may qualify as one if they exert significant control over the company or own at least 25 percent of its ownership interests.

Not necessarily. The determination of whether a specific director meets any of the criteria of a beneficial owner is something the reporting company must evaluate on a case-by-case basis.

If a beneficial owner holds ownership interests exclusively through exempt entities, the reporting company can list the names of these exempt entities instead of individual details. However, if a combination of exempt and non-exempt entities exist, individual beneficial owners must be reported unless an exception applies.

Typically, accountants and lawyers do not meet the criteria for being beneficial owners. However, a lawyer serving as general counsel, qualifies as a senior officer and thus is considered a beneficial owner. Accountants and lawyers offering standard professional services to a reporting company or acting as agents typically do not meet the definition.

There are five exceptions to the definition of beneficial owner. These are individuals who would otherwise be a beneficial owner but because they qualify for an exception, they will not be reported as a beneficial owner. And those exceptions are for:

- A minor child however, the reporting company has to provide the required personal information of a parent or legal guardian to qualify for this exception,

- An individual acting as a nominee, intermediary, custodian, or agent on behalf of another individual.

- An individual whose only interest in the reporting company is a future interest through a right of inheritance.

- 4. an employee of the reporting company, acting solely as an employee, provided, however, that the individual is not a senior officer, and

- A creditor of the reporting company.

Typically, individuals indirectly controlling or owning 25% or more through the corporate entity should be reported. Exceptions may apply in cases involving exempt entities or identical beneficial owners.

A beneficial owner is any individual who either:

- Exercises substantial control over a reporting company, or

- Owns or controls at least 25 percent of a reporting company’s ownership interests.

Exercising substantial control or owning or controlling ownership interests may be direct or indirect, including through any contract, arrangement, understanding, relationship, or otherwise.

Trust arrangements vary. The specific facts and circumstances determine whether particular trustees, beneficiaries, grantors, settlors, and other individuals with roles in a trust are beneficial owners of a reporting company whose ownership interests are held through that trust.

For instance:

- Trustees of a trust may be beneficial owners by:

- Exercising substantial control over the reporting company, or

- Owning or controlling at least 25 percent of the ownership interests in the company through a trust or similar arrangement.

- Beneficiaries and grantors or settlors may also own or

control ownership interests in a reporting company

through a trust. The following conditions indicate such

ownership or control:

- A trustee (or any other individual) has the authority to dispose of trust assets;

- A beneficiary is the sole permissible recipient of income and principal from the trust, or has the right to demand a distribution of or withdraw substantially all of the assets from the trust;

- A grantor or settlor has the right to revoke the trust or otherwise withdraw the assets of the trust.

This list may not be exhaustive. Due to varying facts and circumstances, other arrangements may exist where individuals associated with a trust are beneficial owners of any reporting company in which that trust holds interests.

For this question, a "corporate trustee" refers to a legal entity, not an individual, acting as a trustee in a trust arrangement.

If a reporting company’s ownership interests are controlled through a trust with a corporate trustee, the reporting company must determine if any individual beneficial owners of the corporate trustee indirectly own or control at least 25 percent of the reporting company’s ownership interests through their stakes in the corporate trustee.

For example:

- If an individual owns 60 percent of the corporate trustee, and the trust holds 50 percent of the reporting company’s ownership interests, the individual owns or controls 30 percent (60 percent × 50 percent = 30 percent) of the reporting company’s ownership interests, making them a beneficial owner.

- Conversely, if the trust holds only 30 percent of the reporting company’s ownership interests, the individual would own or control only 18 percent (60 percent × 30 percent = 18 percent) of the reporting company, and thus would not be a beneficial owner by virtue of ownership or control of ownership interests.

A reporting company may report the corporate trustee's name instead of individual beneficial owner information only if all three of the following conditions are met:

- The corporate trustee is exempt from the reporting requirements.

- The individual beneficial owner owns or controls at least 25 percent of the reporting company's ownership interests solely through their ownership in the corporate trustee.

- The individual beneficial owner does not exercise substantial control over the reporting company.

In addition to evaluating the ownership interests, the reporting company must also consider whether any individuals associated with the corporate trustee exercise substantial control over the reporting company. The criteria for determining substantial control by an individual related to a corporate trustee are the same as for any other beneficial owner.

Yes, beneficial owners can own or control a reporting company through trusts. This can occur either by exercising substantial control over the reporting company via a trust arrangement or by owning or controlling the company's ownership interests that are held in a trust.

An individual owning at least 25% of the ownership interests of a reporting company is a beneficial owner. Regarding whether an individual may hold ownership interests in a reporting company through a trust, the rule states:

“An individual may directly or indirectly own or control an ownership interest of a reporting company through any contract, arrangement, understanding, relationship, or otherwise, including:

- As a trustee of the trust or another individual with the authority to dispose of trust assets;

- As a beneficiary Who:

- Is the sole permissible recipient of income and principal from the trust; or

- Has the right to demand a distribution of or withdraw substantially all of the assets from the trust; or

- As a grantor or settlor who has the right to revoke the trust or withdraw the trust assets.

A trust itself cannot be a beneficial owner, because a beneficial owner must be a person. However, if the trust owns at least 25% of a reporting company or has substantial control over a company, it must report its beneficial owner. As it applies to trusts, a beneficial owner is someone who benefits from the trust or can make decisions related to its assets.

In many cases, the trustee will be the beneficial owner under the CTA. The law considers a trustee to be a beneficial owner if they have substantial control over a reporting company. A trustee may also hold ownership interests in a reporting company through a trust. For example, if the trustee has the authority to dispose of trust assets or control the shares held by the trust, they will likely be a beneficial owner.

Besides trustees, beneficiaries and grantors or settlors of a trust can also be beneficial owners in some cases. Specifically, the law states that a beneficial owner can be:

- A beneficiary who is the sole permissible recipient of income and principal from the trust.

- A beneficiary who has the right to demand a distribution or withdrawal of the trust assets.

- A grantor or settlor who has the right to revoke the trust or withdraw trust assets.

It’s important to know there may be multiple beneficial owners associated with a trust under the CTA. For example, a trustee, beneficiary, and grantor could all be beneficial owners of a trust. If you believe your trust may fall within the scope of the CTA, we strongly encourage you to work with an advisor who can review your trust and determine the beneficial owner(s) to ensure you comply fully with the law.

A trustee of a trust may exercise substantial control over a reporting company. The rule implementing the CTA’s reporting requirement states as follows:

“An individual may directly or indirectly, including as a trustee of a trust or similar arrangement, exercise substantial control over a reporting company through:

- Board representation;

- Ownership or control of a majority of the voting power or voting rights of the reporting company;

- Rights associated with any financing arrangement or interest in a company;

- Control over one or more intermediary entities that separately or collectively exercise substantial control over a reporting company;

- Arrangements or financial or business relationships, whether formal or informal, with other individuals or entities acting as nominees; or

- Any other contract, arrangement, understanding, relationship, or otherwise.”

No, registering a trust with a court of law to establish jurisdiction over potential disputes related to the trust does not confer reporting company status. However, if the trust is registered with a secretary of state, it is likely considered a reporting company. .

If ownership is disputed and no initial Beneficial Ownership Information (BOI) report is filed, the reporting company should list all individuals with substantial control over the company and those holding at least 25% ownership interests. If an initial report exists, it must be updated within 30 days of resolving the dispute.

A homeowners association (HOA) that qualifies as a reporting company and does not meet any exemptions, must report its beneficial owner(s). A beneficial owner is any individual who either directly or indirectly: (1) exercises substantial control over the reporting company, or (2) owns or controls at least 25 percent of the ownership interests of the reporting company.

- Exercises substantial control over the reporting company, or

- Owns or controls at least 25 percent of the ownership interests of the reporting company.

There may be cases where no individuals own or control at least 25 percent of an HOA's ownership interests. However, FinCEN expects that at least one individual exercises substantial control over each reporting company. Individuals are considered to exercise substantial control over the HOA if they:

- Are a senior officer;

- Have the authority to appoint or remove certain officers or a majority of directors of the HOA;

- Are key decision-makers;

- Have any other form of substantial control over the HOA.

An entity that is disregarded for U.S. tax purposes—a “disregarded entity”—is not treated as an entity separate from its owner for U.S. tax purposes. Instead of a disregarded entity being taxed separately, the entity’s owner reports the entity’s income and deductions as part of the owner’s federal tax return.

A disregarded entity must report beneficial ownership information (BOI) to FinCEN if it is deemed a reporting company. Such a reporting company must provide one of the following types of taxpayer identification numbers (TINs) on its BOI report if it has been issued a TIN: an Employer Identification Number (EIN); a Social Security Number (SSN); or an Individual Taxpayer Identification Number (ITIN). If a foreign reporting company has not been issued a TIN, it must provide a tax identification number issued by a foreign jurisdiction and the name of that jurisdiction.

Consistent with rules of the Internal Revenue Service (IRS) regarding the use of TINs, different types of tax identification numbers may be reported for disregarded entities under different circumstances:

- If the disregarded entity has its own EIN, it may report that EIN as its TIN. If the disregarded entity does not have an EIN, it is not required to obtain one to meet its BOI reporting requirements so long as it can instead provide another type of TIN or, if a foreign reporting company not issued a TIN, a tax identification number issued by a foreign jurisdiction and the name of that jurisdiction.

- If the disregarded entity is a single-member limited liability company (LLC) or otherwise has only one owner that is an individual with an SSN or ITIN, the disregarded entity may report that individual’s SSN or ITIN as its TIN.

- If the disregarded entity is owned by a U.S. entity that has an EIN, the disregarded entity may report that other entity’s EIN as its TIN.

- If the disregarded entity is owned by another disregarded entity or a chain of disregarded entities, the disregarded entity may report the TIN of the first owner up the chain of disregarded entities that has a TIN as its TIN.

As explained above, a disregarded entity that is a reporting company must report one of these tax identification numbers when reporting beneficial ownership information to FinCEN.

No, unless a sole proprietorship was created (or, if a foreign sole proprietorship, registered to do business) in the United States by filing a document with a secretary of state or similar office.

An entity is a reporting company only if it was created (or, if a foreign company, registered to do business) in the United States by filing such a document.

Filing a document with a government agency to obtain (1) an IRS employer identification number, (2) a fictitious business name, or (3) a professional or occupational license does not create a new entity, and therefore does not make a sole proprietorship filing such a document a reporting company.

Yes. Reporting companies created or registered in 2024 must report their beneficial ownership information to FinCEN within 90 days of receiving actual or public notice of creation or registration. Reporting companies created or registered in 2025 or later must report their beneficial ownership information to FinCEN within 30 days of receiving actual or public notice of creation or registration.

These obligations remain applicable to reporting companies that cease to exist as legal entities—meaning wound up their affairs, ceased conducting business, and entirely completed the process of formally and irrevocably dissolving—before their initial beneficial ownership reports are due. If a reporting company files an initial beneficial ownership information report and then ceases to exist, then there is no requirement for the reporting company to file an additional report with FinCEN noting that the company has ceased to exist.

Reporting companies must include the following information about their business entity:

- Legal name

- DBAs (Doing Business As) or trade names, if applicable

- A principal business address in the U.S.

- Formation or registration jurisdiction (state, tribal, or foreign)

- Federal taxpayer ID number (TIN, Social Security Number, EIN)

A Reporting Company must furnish:

- Legal name

- Any trade names, "doing business as" (d/b/a), or "trading as" (t/a) names

- Current street address of its principal place of business (if located in the United States) or the present address from which the company conducts business in the United States (for foreign reporting companies)

- Jurisdiction of formation or registration

- Taxpayer Identification Number (or a foreign-issued tax identification number if applicable)

Additionally, the Reporting Company must specify whether it is submitting an initial report, a correction, or an update of a prior report.

The disclosure requirements depend on the timing of the company's creation or registration:

- If a reporting company is established or registered on or after January 1, 2024, it must report details about itself, its beneficial owners, and its company applicants.

- If a reporting company was created or registered before January 1, 2024, it only needs to furnish information regarding itself and its beneficial owners (company applicants' information is not required).

If a reporting company does not have a principal place of business in the United States, then the company must report to FinCEN as its address the primary location in the United States where it conducts business.

If a reporting company has no principal place of business in the United States and conducts business at more than one location within the United States, then the reporting company may report as its primary location the address of any of those locations where the reporting company receives important correspondence.

If a reporting company has no principal place of business in the United States and does not conduct business functions at any location in the United States, then its primary location is the address in the United States of the person that the reporting company, under State or other applicable law, has designated to accept service of legal process on its behalf. In some jurisdictions, this person is referred to as the reporting company’s registered agent, or the address is referred to as the registered office. Such a reporting company should report this address to FinCEN as its address.

No, a reporting company address must be a U.S. Street address and cannot be a P.O. box.

The requirement to report company applicants applies solely to reporting companies established or registered after January 1, 2024. Companies formed before 2024 are not obligated to disclose their company applicant(s) information.

A reporting company obligated to report its company applicant(s) can identify up to two individuals who:

- Directly submits the document establishing or registering the reporting company.

- Are primarily responsible for directing or controlling the filing process (in some cases, this may involve multiple individuals).

For example, an attorney at a law firm providing business formation services may oversee the preparation and filing of a reporting company’s incorporation documents. If a paralegal directly files the documents at the attorney’s direction, both the attorney and the paralegal are considered company applicants for the reporting company.

A maximum of two individuals may be submitted as company applicants (not a company).

A company applicant is a person who physically or electronically files a business registration application with the state to form an LLC, Corporation, or other legal entity or who files an application to register a non-U.S. company to conduct business in the United States.

If more than one individual is involved in the reporting company’s formation filing process, both the person who directly filed the formation document and the individual who helped direct or control the filing must be included in the BOI report.

No. Only domestic reporting companies created on or after January 1, 2024, and foreign reporting companies first registered to do business in the U.S. on or after January 1, 2024, must include their company applicants in their BOI report.

For each individual designated as a company applicant, a reporting company must disclose:

- The individual’s name;

- Date of birth;

- Address*; and

- An identifying number from an acceptable identification document, such as a passport or U.S. driver’s license, along with the issuing state’s name or jurisdiction of the identification document. An image of the identification document used to obtain the identifying number disclosed must also be provided.

*If the company applicant is involved in corporate formation, such as working as an attorney or corporate formation agent, the reporting company must report the business address of the company applicant. Otherwise, the residential address of the company applicant must be reported.

If the company applicant has a FinCEN identifier, it can be used in place of the above information.

No, a company applicant cannot be removed from a BOI report even if they no longer have a relationship with the reporting company. For reporting companies created on or after January 1, 2024, company applicant information must be reported in the initial BOI report, and updates are not required if the relationship changes.

If a business formation service only provides software, online tools, or generally applicable written guidance that are used to file a creation or registration document for a reporting company, and employees of the business service are not directly involved in the filing of the document, the employees of such services are not company applicants.

If the service only provides tools and employees are not directly involved, only the individual who files through the service is the company applicant.

No. A third-party courier or delivery service employee who only delivers documents to a secretary of state or similar office is not a company applicant provided they meet one condition: the third-party courier, the delivery service employee, and any delivery service that employs them does not play any other role in the creation or registration of the reporting company.

When a third-party courier or delivery service employee is used solely for delivery, the individual (e.g., at a business formation service or law firm) who requested the third-party courier or delivery service to deliver the document will typically be a company applicant.

Under FinCEN’s regulations, an individual who “directly files the document” that creates or registers the reporting company is a company applicant. Third-party couriers or delivery service employees who deliver such documents facilitate the documents’ filing, but FinCEN does not consider them to be the filers of the documents given their only connection to the creation or registration of the reporting company is couriering the documents.

Rather, when a third-party courier or delivery service is used by a firm, the company applicant who “directly files” the creation or registration document is the individual at the firm who requests that the third-party courier or delivery service deliver the documents.

- For example, an attorney at a law firm may be involved in the preparation of incorporation documents. The attorney directs a paralegal to file the documents. The paralegal may then request a third-party delivery service to deliver the incorporation documents to the secretary of state’s office. The paralegal is the company applicant who directly files the documents, even though the third-party delivery service delivered the documents on the paralegal’s behalf. The attorney at the law firm who was involved in the preparation of the incorporation documents and who directed the paralegal to file the documents will also be a company applicant because the attorney was primarily responsible for directing or controlling the filing of the documents.

In contrast, if a courier is employed by a business formation service, law firm, or other entity that plays a role in the creation or registration of the reporting company, such as drafting the relevant documents or compiling information to be submitted as part of the documents delivered, the conclusion is different. FinCEN considers such a courier to have directly filed the documents—and thus to be a company applicant—given the courier’s greater connection (via the courier’s employer) to the creation or registration of the company.

- For example, a mailroom employee at a law firm may physically deliver the document that creates a reporting company at the direction of an attorney at the law firm who is primarily responsible for decisions related to the filing. Both individuals are company applicants.

Up to two individuals can be reported as company applicants: the person who files the registration document (i.e., paralegal) and the one primarily responsible for directing or controlling the filing based on decision-making authority (i.e., lawyer, accountant).

For the purposes of determining who is a company applicant, it is not relevant who signs the creation or registration document, for example, as an incorporator. To determine who is primarily responsible for directing or controlling the filing of the document, consider who is responsible for making the decisions about the filing of the document, such as how the filing is managed, what content the document includes, and when the filing occurs.

The following three scenarios provide examples:

- Scenario #1: Consider an attorney who

completed a company creation document using information

provided by a client, and then sends the document to a

corporate service provider for filing with a secretary

of state. In this example:

- The attorney is the company applicant who is primarily responsible for directing or controlling the filing because they prepared the creation document and directed the corporate service provider to file it.

- The individual at the corporate service provider is the company applicant who directly filed the document with the secretary of state.

- Scenario #2: If the attorney instructs a paralegal to complete the preparation of the creation document, rather than doing so themself, before directing the corporate service provider to file the document, the outcome remains the same: the attorney and the individual at the corporate service provider who files the document are company applicants. The paralegal is not a company applicant because the attorney played a greater role than the paralegal in making substantive decisions about the filing of the document.

- Scenario #3: If the client who initiated the company creation directly asks the corporate service provider to file the document to create the company, then the client is primarily responsible for directing or controlling the filing, and the client should be reported as the company applicant, along with the individual at the corporate service provider who files the document.

Whether an accountant or lawyer is considered a company applicant depends on their role in filing the document that establishes or registers a reporting company. Frequently, company applicants may be associated with a business formation service or law firm.

An accountant or lawyer may be designated as a company applicant if they directly submit the document creating or registering the reporting company. If multiple individuals are involved in the filing, an accountant or lawyer may be a company applicant if they are primarily responsible for directing or controlling the filing.

For example, an attorney at a law firm providing business formation services may oversee the preparation and filing of a reporting company’s incorporation documents. If a paralegal directly files the documents at the attorney’s direction, both the attorney and the paralegal are considered company applicants for the reporting company.

Not all reporting companies are required to disclose their company applicants to FinCEN. The obligation to report company applicants applies solely to a reporting company established or registered to do business in the United States on or after January 1, 2024. Companies formed before 2024 are not required to report their company applicants.

The following file types are accepted for identification import: GIF, HEIC, JPG, PNG.

Please note PDF files are not accepted.

The reporting requirement mandates submission of only the following acceptable forms of identification:

- A non-expired U.S. driver’s license (including those issued by a commonwealth, territory, or possession of the United States).

- A non-expired identification document issued by a U.S. state, local government, or Indian Tribe.

- A non-expired passport issued by the U.S. government.

- A non-expired passport issued by a foreign government (only when other forms of identification are unavailable).

Yes, if an identification document lacks a photo for religious reasons but is an accepted type, it can be submitted along with the report.

The Corporate Transparency Act (CTA) specifies that a company may qualify for the large operating company exemption based on a Federal income tax or information return filed “in” the previous year, while FinCEN’s regulations refer to tax or information returns filed “for” the previous year. To the extent a tax or information return for the previous year was not filed in the previous year (e.g., because a company has not filed its return for the previous year at the time beneficial ownership information is required to be reported, or because the return filed in the previous year was for a prior year), a company should use the return filed in the previous year for purposes of determining its qualification for the exemption. If a company relying on this exemption subsequently files a tax return demonstrating less than $5 million in gross sales or receipts, and it no longer qualifies for the large operating company exemption or any other exemption, it has 30 days from the date of the tax return to file an initial BOI report. The Federal income tax or information return must demonstrate more than $5,000,000 in gross receipts or sales, as reported as gross receipts or sales (net of returns and allowances) on the entity’s IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form, excluding gross receipts or sales from sources outside the United States, as determined under Federal income tax principles.

Take a quick compliance quiz here: https://snapboi.com/compliance-quiz

The SnapBOI services are not legal or tax advice. Users should consult with qualified legal and/or tax counsel for legal or tax advice.

Yes, 23 types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

Reporting Companies May Not Consolidate Employee Headcount Across Affiliated Companies.

The Preamble to the final Beneficial Ownership Information Reporting Requirement regulations (hereafter, “the final regulations”) specifically cites the statutory exemption language, which states that “the determination of the number of employees is to be made on an entity-by-entity basis.”

This is the opposite treatment under prong two of the large operating company exemption, reported gross receipts of $5 million or more in the prior year’s tax return, which allow gross receipts and sales to be consolidated across affiliated companies.

The Corporate Transparency Act refers to the Employer Shared Responsibility definition of Full-Time Employee. The large filing exemption test’s first prong requires that the entity have “more than 20 full-time employees in the United States.”

The CTA refers to the same section of the Internal Revenue Code (Code) that is used to define “full-time employee” for the Affordable Care Act’s Employer Shared Responsibility (ESR) penalty, with one notable exception.1 The CTA excludes the section of the Code that requires companies to calculate the number of their “full-time equivalent” (FTE) employees.2 While FinCEN has yet to confirm, this means that companies only have to look at the service hours performed by their hourly and non-hourly employees for the CTA exemption.

Because the penalty for not filing a BOI report can be severe, any reporting company that hopes to rely on the large operating company exemption to avoid filing will need to make certain it is entitled to the exemption by examining closely each of its prongs, including the prong that counts the number of “employees.”

Definition of Full-Time Employee and Hour of Service

Under the Code’s relevant sections, a full-time employee is a common-law employee (which excludes leased employees, sole proprietors, a partner in a partnership, and 2% S Corp shareholders) who works an average of 30 hours of service a week or 130 hours of service a month. An hour of service is any hour for which an employee is paid or entitled to payment (e.g., vacation, illness, or leave of absence).

Hours of service for hourly employees are calculated by counting actual hours of service from records of hours worked and hours for which payment is made or due.

Hours of service for non-hourly employees can be determined by (1) counting actual hours of service from records of hours worked and hours for which payment is made or due, (2) using a days-worked equivalency, or (3) using a weeks-worked equivalency. Options (2) and (3) can’t be used if they substantially understate the employee’s hours of service.

A company can use different methods for different groups of non-hourly employees if the categories are consistent and reasonable. A company can change the method of calculating the hours of service of non-hourly employees for each calendar year.

There are 23 distinct types of entities which are exempt from the obligations to report beneficial ownership information. These include publicly traded companies meeting specific criteria, numerous nonprofits, and certain large operating companies.

The most common exemption is the "large operating company" exemption, which necessitates that a business has both, 20 or more full-time employees, and $5 million or more in U.S. sourced revenue on its last business tax return to qualify and has a physical location in the US.

The list below provides an overview of the 23 available exemptions:

- Securities reporting issuer required to file supplementary and periodic information under section 15(d) of the Securities Exchange Act of 1934.

- Company that exerts governmental authority on behalf of a State or Tribe.

- Registered Bank

- Registered Credit union

- Registered depository institution holding company

- Registered money services business

- SEC-registered broker or dealer in securities

- SEC registered securities exchange or clearing agency

- Company registered under the Commodity Exchange Act

- SEC-registered investment company or investment adviser

- SEC-registered venture capital fund adviser

- Registered Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Registered accounting firm

- Public utility company

- Financial market utility company designated by the Financial Stability Oversight Council.

- Pooled investment vehicle operated by an SEC registered person

- Tax-exempt entity

- Entity that exclusively exists to provide financial assistance or governance to a tax-exempt entity.

- Entity 100% owned by an exempt entity

- Inactive entity created before 1/1/2020 that holds no assets, is not engaged in any business, has no foreign owners, and has not sent or received money or changed ownership in the prior 12 months.

- Large operating company

FinCEN regulations DO NOT automatically exempt churches from BOI reporting if they do not have a determination letter. Therefore, churches that have operated as a 501(c)(3), but under the presumption of tax-exemption, ARE required to file their BOI information and future updates.

Before determining your company's exemption status, carefully review the criteria associated with each exemption. Alternatively, use the Exemption Tool for assistance.