Contents

Recently updated on July 21st, 2025 at 08:49 am

73% of Accounts Payable Professionals Relying on Manual Process Face Slow Processing & Late Payment – Source

The accounts payable process across industries is still manual, paper-based. As a result, businesses are prone to missing invoices, delay in vendor reconciliation, vendor management, maintaining records, late payments, fraud, duplications, and more.

Let’s have a deeper understanding of how the accounts payable workflow would be when done manually.

It’s a reality. Let’s face it. Accounts Payables continue to be manual, tedious, and mundane for most businesses across diverse industries. However, accounts payable automation is the key to optimizing the complete accounts payable workflow and stay on top of the game.

Transformation from manual to automated accounts payable is no longer a “nice to have” strategic move, rather, it’s a “must have” for all future-focused firms. The Accounts Payable automation market is expected to reach up to USD 2 billion by 2029. Mention not, the need of transformation from manual accounts payable process to automation is different across industries. And guess what?

Here, you have the opportunity to dive deep into accounts payable automation journey of businesses across industries. So, keep scrolling to find out more about some real case studies.

Real-World Case Studies: Accounts Payable Automation Across Industries

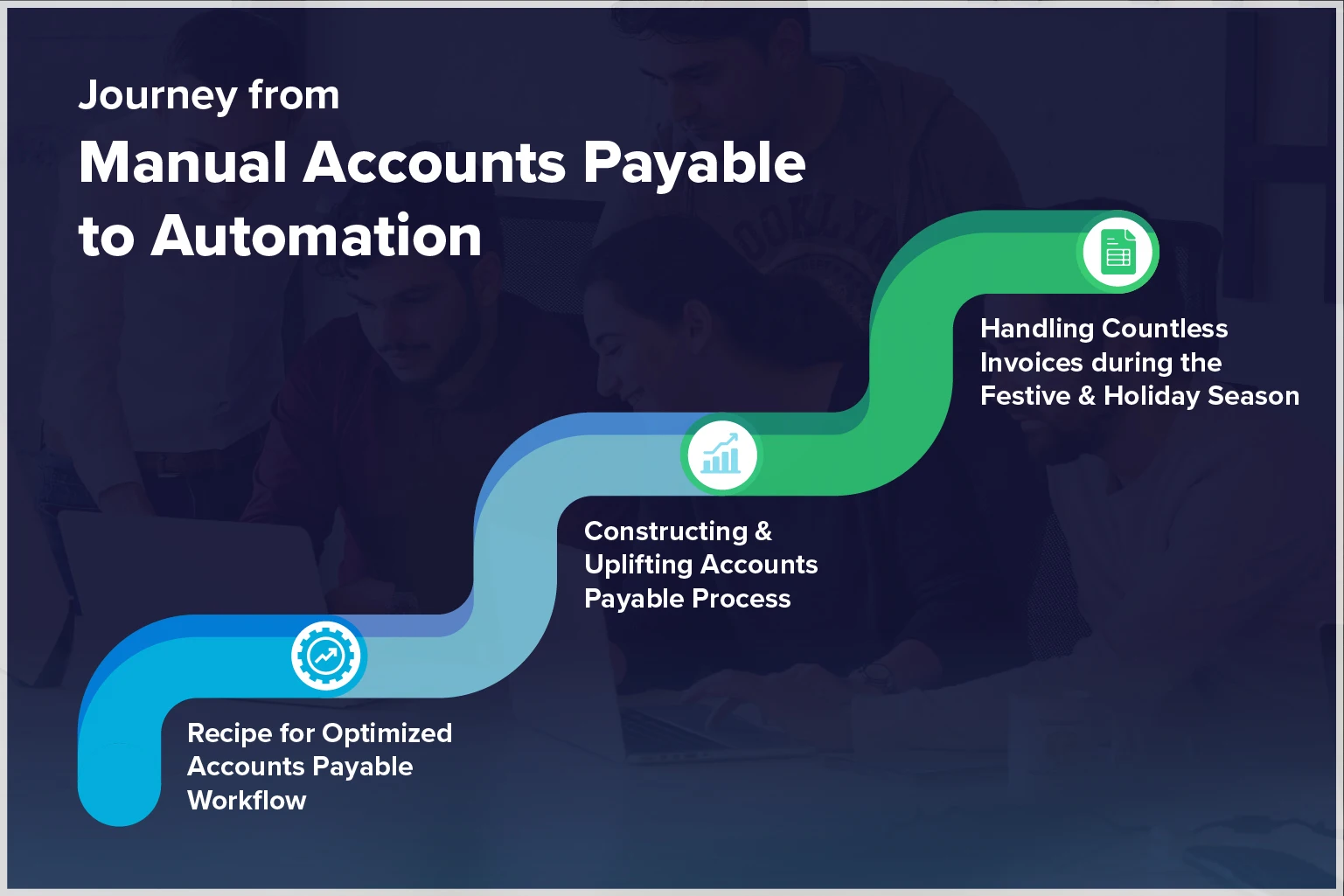

Recipe for Optimized Accounts Payable Workflow

Introducing Mr. Dan Chef, the owner of a food truck chain. His business was constantly buzzing due to great recipes and top-notch customer service. With the increase in footfall, the team processed countless invoices, delivery notes, vendor reconciliation, kitchen invoice summary, stock-take and spent time matching purchase orders.

However, seamless invoice tracking and payment processing emerged as major challenges for Dan as the accounts payable process was manual, tedious and labor intensive. The need for higher accuracy in less time complicated the process.

Thin margins, uneven cash flow and cut-throat competition in the food and hospitality industry forced Dan to automate the accounts payable workflow and manage cash flow efficiently. That’s the problem. The solution?

Dan shifted from manual process to accounts payable automation.

Dan Simplified Accounts Payable for Multiple Locations.

Automated AP solution allowed Dan to manage & pay bills faster with vendors’ preferred methods, including PO system, ACH, BACS, Credit card, Wallets, Paypal and check payments. It enabled him to track invoices, approvals, payment status, posting details, and audit trails in real-time. He not only doubled the speed of invoice processing but also streamlined the complete accounts payable workflow. He also had the best control and visibility over business expenses while getting rid of any late, duplicate, and fraudulent payments.

There’s no need to get hunched over screen for entering data, tracking invoices and purchase orders, as he could approve the bills on the phone using the App – Click and Done. This enabled him to bring back focus on his culinary service, acquiring new guests, making new recipes, keeping both his vendors and customers happy.

According to WorkMarket’s 2020 In(Sight) Report, 54% of employees believe they could save 240 hours annually through automation.

Constructing & Uplifting Accounts Payable Process

Being in an increasingly competitive industry like construction, Mr. Homes wears a lot of hats to complete projects with required specification and timelines. He always tries to stay ahead of the innovation curve when it comes to building practices and construction methods. However, the accounts payable process was manual.

It’s a no-brainer that multiple challenges like payment errors, security breaches, delay in vendor reconciliation, poor cash flow visibility, wrong approvals and more are the side-effects of manual and mundane accounts payable processes. And Homes even struggled passing physical invoices around for manual approvals, which didn’t work because his reviewers were often offsite leaving invoices unattended.

Homes was looking for ways to make processing & tracking of invoices, approval and payment more efficient, thereby reducing operating costs. The only solution for accounts payable challenges was to Switch to Accounts Payable Automation and bring back focus on core business objectives.

Accurate Records and Quick Payments with Automation

Accounts Payable automation enables Homes with real-time access to payment methods, status, and history. Smart OCR replaced manual data entry. This allowed him to import and sync bills quickly from Cloud, File Transfer Protocol (FTP), & E-mail. Yes, yes, and YES! It enabled him to issue and track payments from his job site, office, or home through the mobile app. Moreover, it eliminated the possibility of late, duplicate and fraudulent payments.

Homes finally automated and streamlined the complete Accounts Payable workflow by keeping his current system intact. He had the best control and visibility over business expenses.

Handling Countless Invoices during the Festive & Holiday Season

Mr. Mart, a renowned retail owner, handles hundreds of different vendors. As a result, real-time tracking of accounts payable metrics is inevitable to stay ahead of the curve. With a higher volume of transactions to process regularly, it was difficult to manage back-office operations manually.

However, rising costs and thin profit margins forced Mart to initiate improvements in back-office operations and cut down the operational costs, leaving no room for inefficiency.

Moreover, amidst the busy holiday season, his team bogged down in managing countless invoices from different vendors and tracking payments. While managing rapid change in demand and prices, accounts payable process was time-consuming and prone to processing errors, resulting in over or underpayment to the vendors. Moreover, the average time to complete accounts payable process reached 25 hours.

Mart was now seriously looking for ways to optimize AP workflow. But how is that possible? Well, replacing manual processes to smart accounts payable automation helped him reduce unnecessary human intervention and capitalize on operational efficiency.

Generate, Send, Approve & Pay Bills with Automation

Smart accounts payable solution helped Mart focus on the things that matter – improve vendor relationships, cut down processing costs and improve cash flow. However, accounts payable automation increased efficiency, reduced transaction errors, optimized workflow and automated audit trail.

The efficient accounts payable process enabled Mart to reduce time taken to generate, send, approve and pay bills. His staff had time to work on new tasks and upgrade skills to instantly meet changing demands of customers. His AP team was receiving all invoices from vendors, vetting through multiple levels of approvals and processing them on a single platform. This smart AP system showed clear visibility of what was paid and what was overdue.

Each business is unique – size, business classification, vendors and customers, number of transactions, business budget and working capital, employees’ skill sets, etc. But reducing cost of operations and increasing cash inflow remains a mission-critical challenge.

Simplify and automate accounts payable workflow with PathQuest AP while keeping your current system intact allowing your business to run smoothly. From easy submission of invoices to faster digital approvals, PathQuest AP ensures better control on expenses while getting rid of any late, duplicate and fraudulent payments. It features automated approval process for posting as well as payment, removing the need of manual approvals. It provides insights into payment patterns and exceptions for better decision-making. It’s a complete Procure to pay system, as simple as plug and play.

Ready to start your journey with us? Book a Free Demo!

FAQS

AP automation solves:

- Manual data entry errors

- Slow invoice approvals

- Late or missed payments

- Paper-based processes

- Lack of visibility into payables

- High processing costs

It streamlines and simplifies the entire accounts payable workflow.

It saves time, reduces manual errors, speeds up payments, improves visibility, strengthens vendor relationships, and cuts costs—making your AP process faster and more efficient.

Key things to consider for AP automation:

- Integration with your accounting/ERP software

- Ease of use and employee onboarding

- Invoice capture and approval workflows

- Payment options (ACH, wire, checks, etc.)

- Security and fraud prevention

- Multi-currency and compliance support

- Reporting and analytics features

- Scalability as your business grows

No, AP automation won’t make accounting jobs obsolete.

It reduces manual tasks but shifts focus to review, analysis, and strategy—helping professionals work smarter, not disappear.

Yes, AP automation can handle multi-currency and international payments.

Most modern AP automation tools support:

- Payments in different currencies

- Automatic currency conversion

- Compliance with international tax and banking regulations

- Integration with global banking systems (SWIFT, SEPA, etc.)

- Vendor communication in different time zones and languages

This makes it easier for global businesses to pay international vendors accurately and on time.

Contact Us

Call Now:

+1 (743) 223-2073