Contents

Recently updated on December 5th, 2024 at 05:02 am

As auto repair shop owners, you juggle numerous responsibilities, from managing repairs to ensuring customer satisfaction. However, amidst the hustle and bustle, gaining insights into your shop’s financial health can often feel like navigating murky waters.

This is where financial reporting comes in! Imagine a system that can automatically generate key reports like income statements (profit & loss statements), balance sheets, and cash flow statements. No more scrambling with spreadsheets or relying on third-party resources. Financial analysis software empowers auto care shop owners to access these critical reports instantly and effortless.

Make Informed Decisions, Share Clear Insights!

For many auto care shop owners, the struggle to stay on top of finances is all too real. From tracking revenue and expenses to managing cash flow and communicating financial health to stakeholders, the challenges can seem overwhelming. However, financial reports offer a solution to these pain points by providing a clear and concise snapshot of your shop’s financial performance. Whether you’re monitoring profitability, assessing liquidity, or planning for growth, these reports empower you to make informed decisions with confidence.

With the ability to auto-generate financial reports, our financial analysis feature puts the power of financial clarity at your fingertips. You can now access comprehensive financial insights with just a few clicks.

Financial reporting software provides a comprehensive suite of reports, each offering a unique perspective on your shop’s financial health:

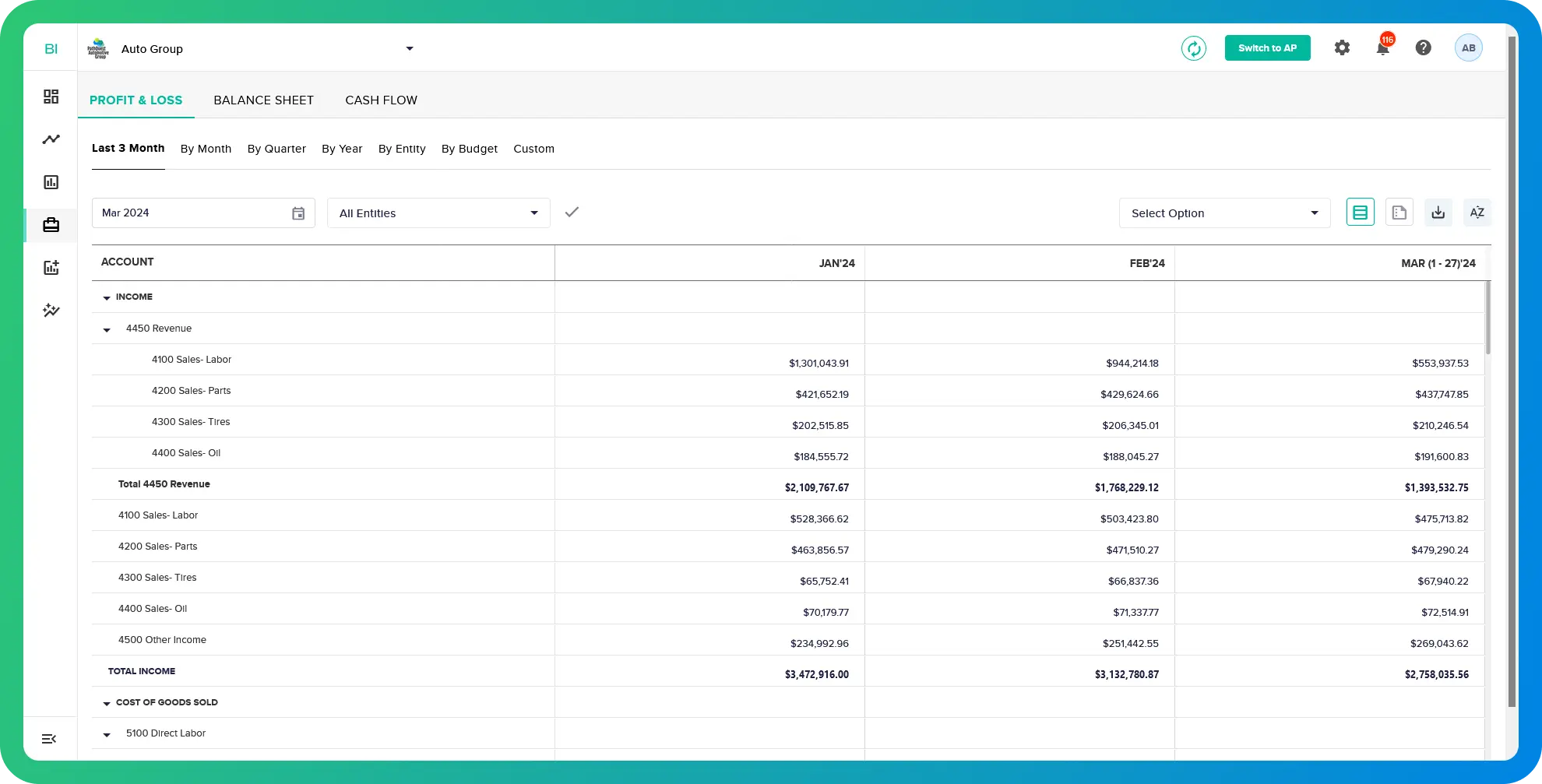

Income Statement (Profit & Loss Statement)

The income statement, also known as the profit & loss statement, provides a clear picture of your shop’s profitability over a specific period. It details your total revenue generated from repairs, parts sales, and other miscellaneous sources. It then subtracts all your operating expenses, such as parts costs, labor costs, rent, and utilities, to arrive at your net profit (or loss) for the period. The income statement is essential for understanding how efficiently you are generating profits.

Key line items on an auto care income statement include:

- Sales/Revenue: Total income generated from repairs and parts sales.

- COGS (Cost of Goods Sold): The cost of parts and materials used in repairs.

- Gross Margin: The difference between revenue and COGS, indicating your profitability on parts sales.

- Retail Overheads (Operating Expenses): All expenses incurred to run your shop, such as labor costs, rent, and utilities.

- EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization): A profitability measure that excludes financing and accounting decisions.

- Store-Level Profit: The individual profit generated by each shop location. Store-level profit, tracked separately, offers insights into the individual shop’s performance, aiding you in decisions on shop openings or closures.

- Net Profit: Your shop’s overall profitability after accounting for all expenses and taxes.

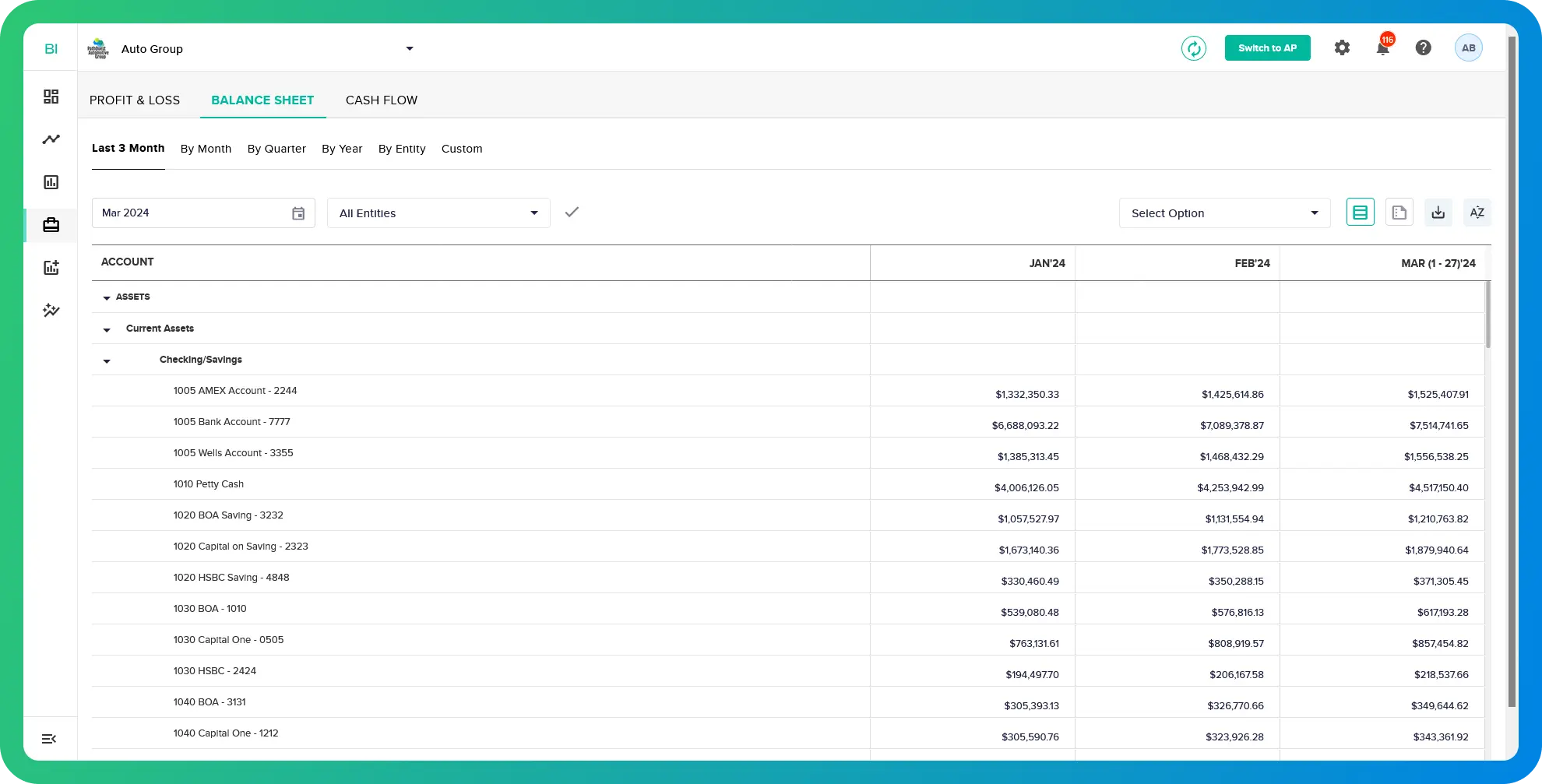

Balance Sheet

Think of the balance sheet as a snapshot of your shop’s financial position at a specific point in time. It categorizes your assets (everything you own, like equipment and inventory) and liabilities (what you owe, such as loans, taxes, wages, interests, dividends, and accounts payable) along with your shareholder equity (the amount of money invested in the business by owners). A healthy balance sheet shows a good balance between assets and liabilities, ensuring you have sufficient resources to cover your debts.

The financial reporting module allows you to easily access balance sheet data for various periods, such as the last three months, by month, quarter, or year. This flexibility ensures a detailed analysis of your auto repair shop’s financial standing, facilitating strategic decision-making for sustained growth.

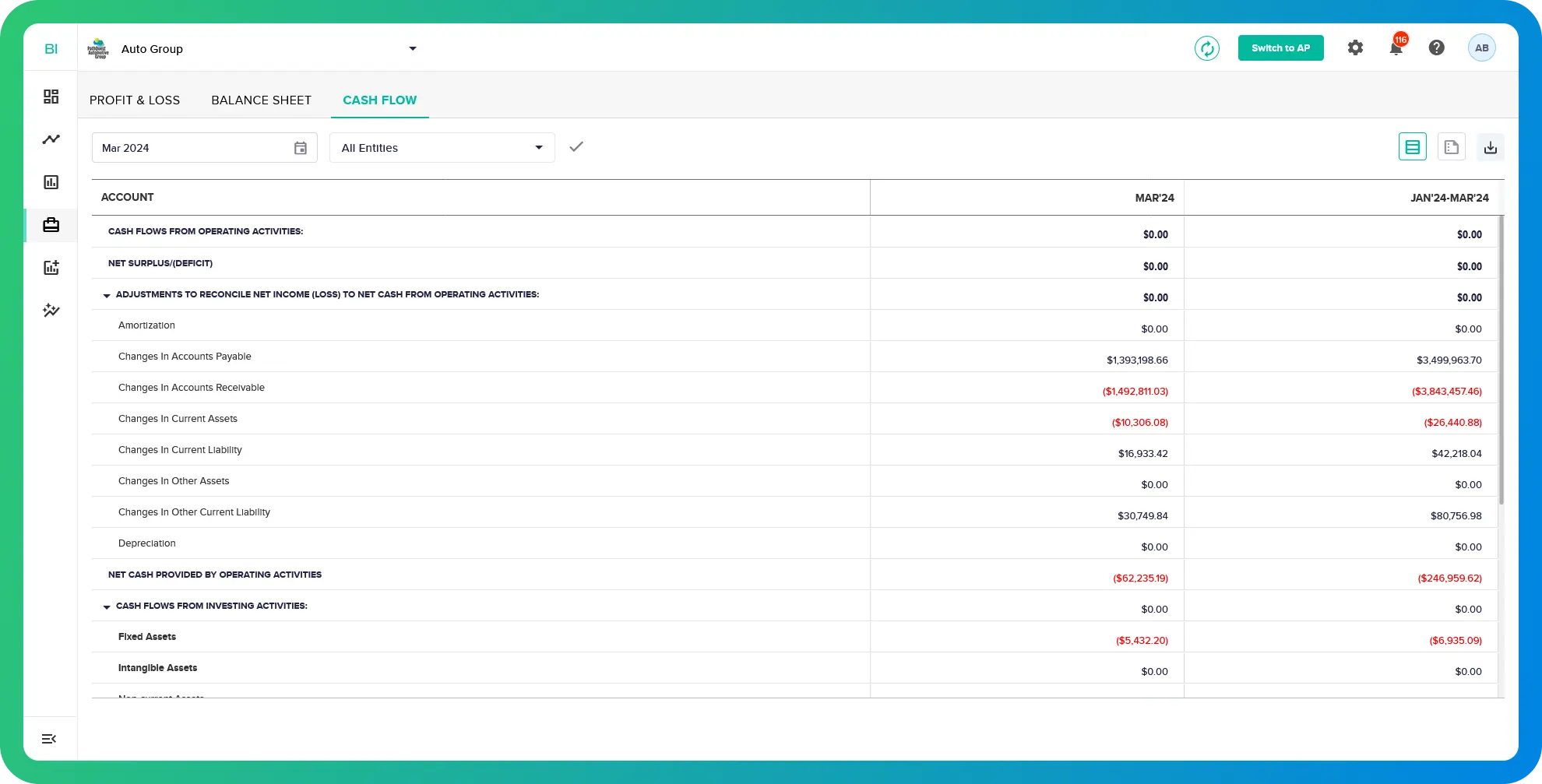

Cash Flow

The cash flow statement tracks the movement of cash in and out of your business. It analyzes your cash flow from three main activities:

- Operating Activities: Day-to-day business transactions like revenue from repairs and parts sales, and payments to suppliers for parts and materials.

- Investing Activities: Purchases or sales of auto parts and other long-term assets.

- Financing Activities: Changes in debt and equity, such as loans taken out or investments made by you.

At the statement’s conclusion, all cash movements are categorized under these activities, determining whether the business is cash flow positive or negative for the given period. To ensure financial health, auto care shop owners are advised to closely monitor cash flow. This practice aids in proactively managing cash flow, anticipating shortages, and ensuring each month concludes with a positive cash balance. By understanding your cash flow, you can make informed decisions about future investments and growth.

Final Thoughts

By leveraging the financial reports feature within our financial analysis software, you can gain invaluable insights, address pain points, and streamline communication with stakeholders. From auto-generating income statements to sharing reports in various formats, this tool empowers you to transform financial management from a headache into a strategic advantage. Say goodbye to financial uncertainty and hello to a smoother ride towards profitability and growth!

Contact Us

Call Now:

+1 (743) 223-2073