Contents

Recently updated on December 4th, 2024 at 11:14 am

According to recent research by Accenture, a whopping 62% of Chief Financial Officers (CFOs) are dealing with a surge in demand for financial insights. However, here’s the twist—53% of them worry that finance is playing catch-up rather than leading the charge. This points to a big gap: the demand for insights is soaring, but multi-location franchises might be struggling to keep up without financial forecasting.

To understand this conundrum, Accenture surveyed around 550 CFOs and financial decision-makers across various companies and industries. The takeaway? The financial planning and analysis department, steering the ship, is facing a serious challenge—keeping up with the ever-changing needs of businesses in a world full of uncertainties.

All this boils down to one thing – agility! Why isn’t the finance team as forward-thinking as they need to be? The survey revealed that finance planning teams spend around 85% of their time on calculation-based labor-intensive tasks and only 15% spend their time on generating advanced insights that can help in planning and forecasting the budget and cash flow of the company.

Prioritizing Financial Forecasting in Retail: Become a Predictive Powerhouse

Now think about what the results derived from the research means for multi-location retail franchises, where the heartbeat of financial decisions echoes across diverse outlets. How can we transition from being caught off guard to proactively preparing for the future in the dynamic world of retail? To bring more agility to financial planning in retail, it is imperative to focus on investing in advanced technology which helps retailers like you to become future-focused.

These advancements empower retailers, like yourself, to adopt a forward-thinking approach. Implementing financial intelligence solutions becomes pivotal, offering intelligent predictions and forecast analytics spanning the income statement, balance sheet, and cash flow. Are you ready to explore the full spectrum of possibilities they offer?

Explore Financial Forecasting Features for Multi-location Retail

Caught up in tasks that eat up time and manpower, multi-location retail businesses often lose sight of essential planning and strategy. But guess what? It doesn’t have to be that way. Now, let’s find out how smart financial analysis software can change the game by giving you accurate predictions for your retail business’s financial future.

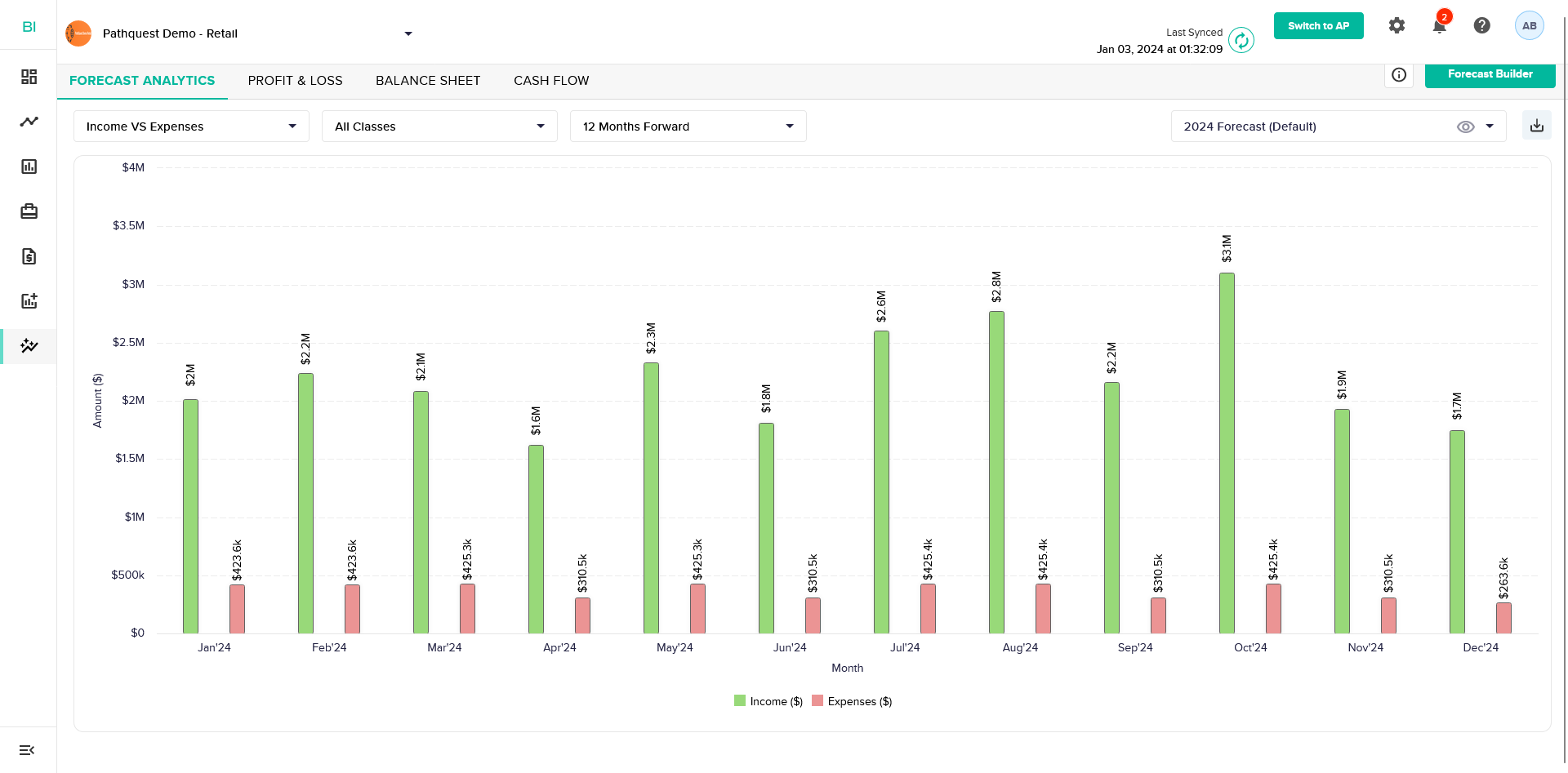

Forecast Analytics

Forecast analytics looks into your current expenses and gives you a heads-up on what to expect in the financial future, stretching up to 24 months from the present. You can easily customize what you want to see in the charts by picking the values you care about, like dollars and months.

There are four types of parameters to choose from for your forecasted data: Income vs Expenses, Revenue, Gross Profit, and Net Profit. And here’s a bonus—Forecast Analytics even lets you download the forecast data in a neat PDF. Want to get more hands-on? Click the Forecast Builder button to create your very own custom forecast. We are going to talk more about this feature later in this blog.

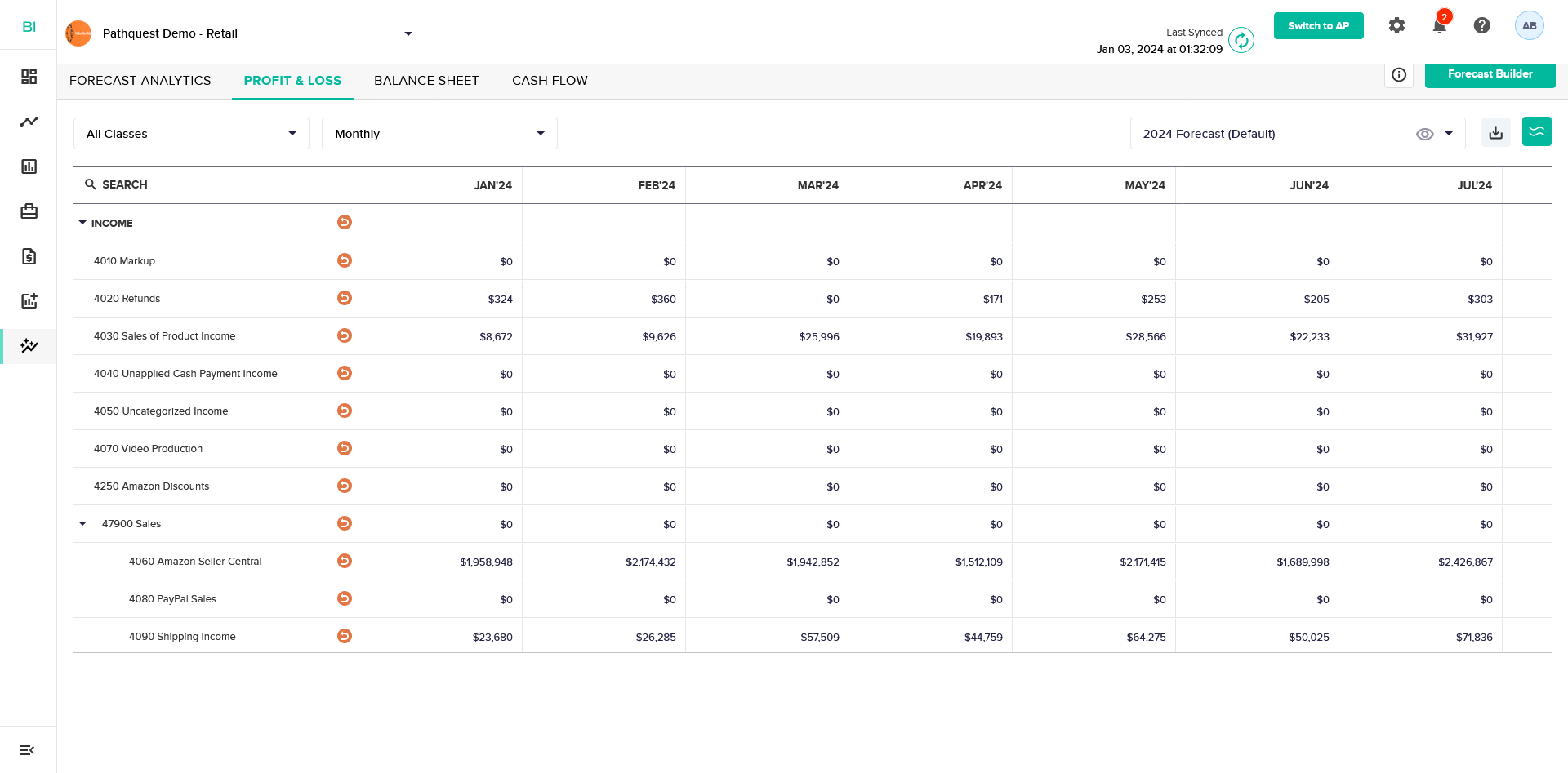

Profit & Loss (P&L) Forecast

You can say that this parameter is like the financial storyteller of your business. This section lays out the details, showcasing values and revenues across different categories like income, cost of goods sold (COGS), operating expenses, and gross profit. Looking for a specific General Ledger (GL) in the data sea? No worries! Just type a few characters in the search box, and voila – the system shows you possible matches. Planning ahead? Profit & Loss Forecast has got your back, offering forecast data for the next two years with the monthly and quarterly options.

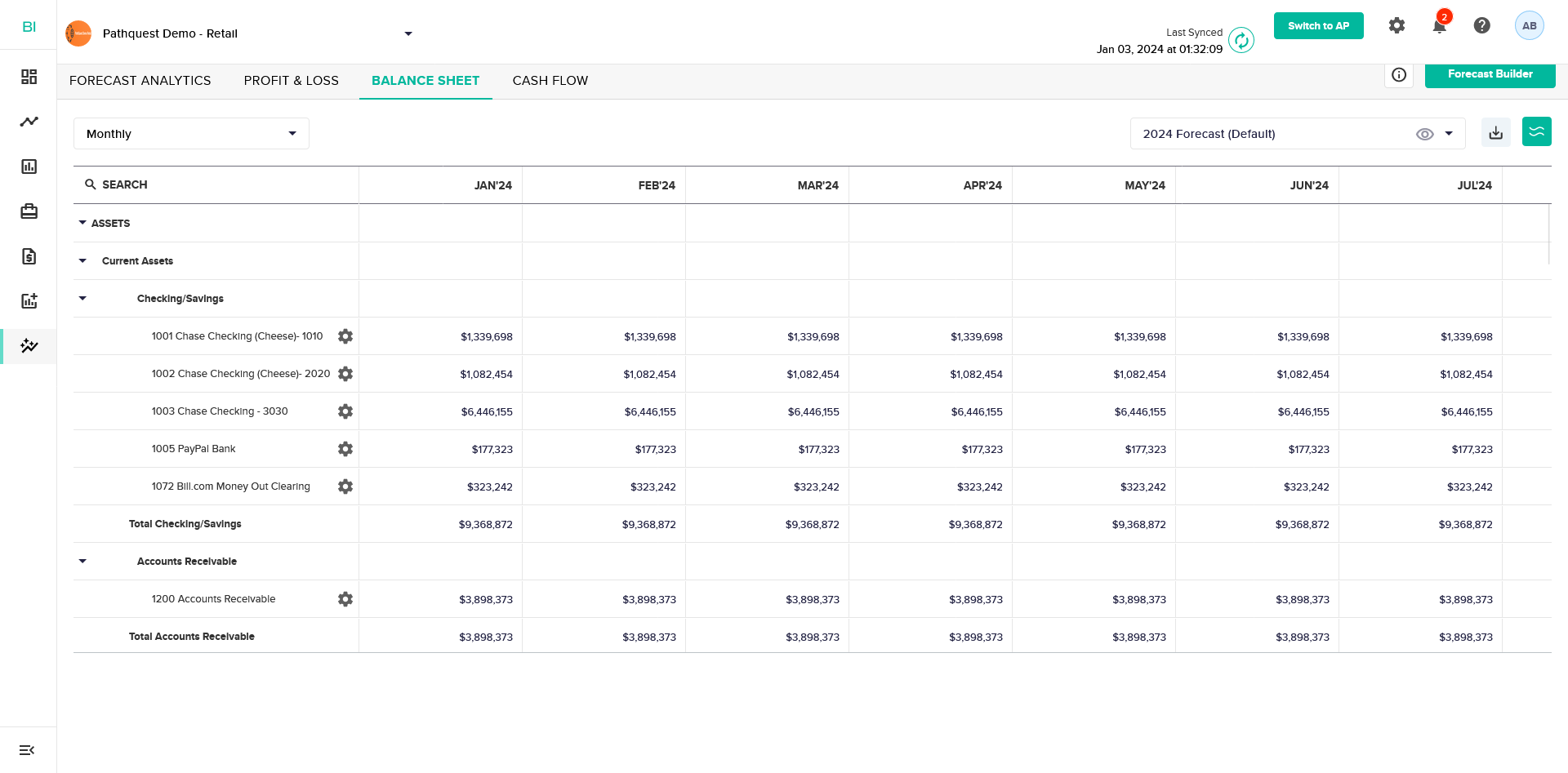

Balance Sheet Forecast

Think of the Balance Sheet Forecast as your financial GPS in the world of multi-location retail. It’s like checking your business’s health report, but for each store. This tool tells you if you’ve got enough money (cash and assets), if you owe too much (liabilities), and how much of the business really belongs to you (equity).

Why does it matter? Well, in the unpredictable world of retail, you need to know if your stores are performing up to the mark. Are you financially ready for whatever’s coming – be it expansion or some financial turbulence? The Balance Sheet Forecast is your practical guide to make sure you’re ready for whatever the retail sea throws at you.

Cash Flow Forecast

Did you know that 82% of businesses face challenges due to poor cash flow management? Having a reliable cash flow forecast is crucial—it’s like having a GPS for your business, helping you navigate financial uncertainties.

In our previous blog on financial reporting in retail, we explored how financial intelligence tools effortlessly generate detailed cash flow insights, facilitating seamless sharing within your team and with stakeholders. This kind of reporting is crucial for understanding your current financial status and historical performance of various retail outlets. However, envisioning and preparing for the future requires a different strategy. Forecasting cash flow for the years ahead is a whole new game.

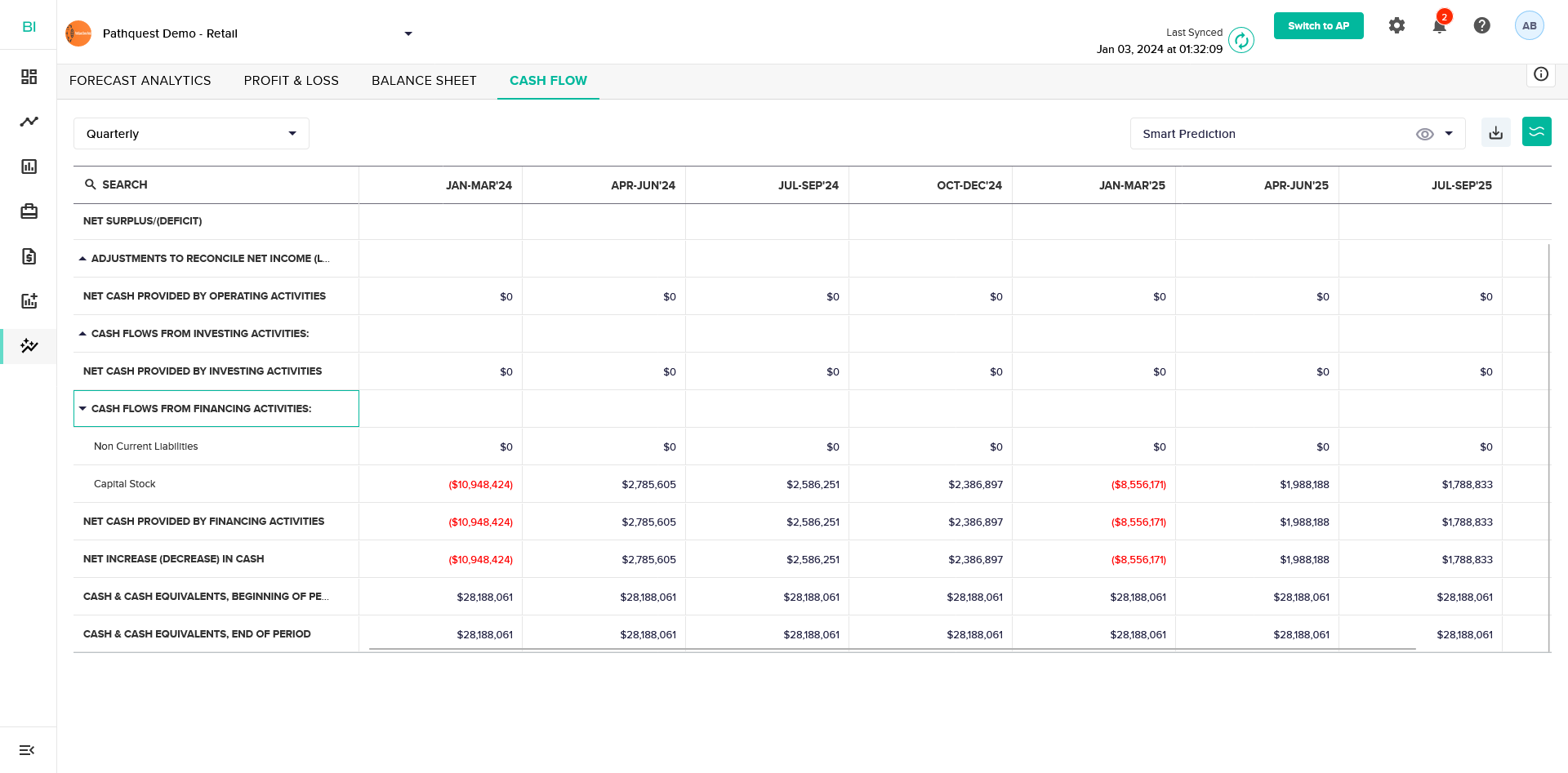

Let’s explore the Cash Flow Forecast feature, a vital component of financial intelligence solutions. This sub-module takes forecast numbers from the Profit & Loss and Balance Sheet, offering a straightforward yet comprehensive view of your financial path.

Smart Prediction: Forecast Builder for Custom Forecasts

Gain foresight with predictive analytics leveraging financial data for future projections. Imagine having the power to predict future financial scenarios and make decisions that steer your multi-location retail franchise in the right direction. That’s exactly what the Forecast Builder offers – a tool that lets you create custom forecasts tailored to your unique needs.

Using the Forecast Builder is as simple as it gets. You can apply or tweak rules by clicking the rule icon on any GL in the grid. There are four main rules at your disposal:

- Smart Prediction: This is the system’s built-in forecast data, displayed based on linear regression for the next 12 months. You can customize it to fit your requirements, choosing between linear regression or average for the last 3, 6, or 12 months.

- Link to Previous Period: Connect your forecast to the previous period’s data, ensuring a seamless flow and consistency in your predictions.

- Constant/Growing: Set your forecast to remain constant or grow over time, aligning it with your business strategy.

- Link to Budget: Establish a link to budgeted values either directly from the accounting system or through manual import.

Once you’ve made your choices, hit the Create button, and your personalized forecast data is ready to guide you in making informed decisions for the future.

Say goodbye to playing catch-up; it’s time to take charge of your financial future. Explore advanced forecasting tools for a competitive edge in retail. Tune in for the next chapter in your retail journey!

Contact Us

Call Now:

+1 (743) 223-2073