Contents

Recently updated on December 4th, 2024 at 11:25 am

Do you feel the whirlwind of change sweeping through our world today? It’s a revolution, and it’s happening right before our eyes, transforming everything at an astonishing pace. Nowhere is this rapid revolution more palpable than in the world of finance.

Being a professional in the field of finance, you must navigate the constantly shifting tides of data and technology. You know that staying ahead of the curve is not just an advantage; it’s a necessity. The financial world is evolving, and to succeed, you must not only keep pace but lead the way.

But here’s the catch – with innovation comes challenges.

Embracing new technology and trends can be a daunting task. It requires understanding, adaptability, and the ability to harness the power of these innovations to your advantage. As we stand on the brink of 2024, we find ourselves at the forefront of this transformative journey. The financial intelligence landscape is a dynamic battleground where technology and data analysis collide, offering unprecedented insights and opportunities. In this era of rapid change, financial intelligence solutions emerge as the vanguards of progress, orchestrating a revolution that promises to reshape how we perceive and manage financial data.

Welcome to this blog, where we embark on a journey to explore the top trends that will define the financial intelligence landscape in 2024 and beyond. From data automation to artificial intelligence (AI) and blockchain, each trend is a beacon of innovation guiding us towards a brighter, more efficient, and insightful financial future.

Top 9 Game-Changing Financial Intelligence Solution Trends

Let’s explore the top trends that are set to revolutionize the world of financial intelligence in 2024.

1. Data Automation for Efficiency

Data management has always been a labor-intensive process, often plagued by manual errors. In previous years, businesses struggled to keep up with the sheer volume of data. Data entry and processing were time-consuming tasks prone to errors. However, data automation is the trend that’s changing the rules of the game for financial intelligence solutions. In 2024, data automation is expected to streamline these processes, reducing the risk of errors and freeing up valuable time for financial professionals and advisory firms to focus on analysis. Data automation within financial intelligence solutions will not only handle routine data entry but also employ AI algorithms to identify anomalies, flag potential errors, and suggest data-driven insights automatically.

In fact, according to recent statistics, 58% of companies are using data automation for data/reporting for planning. By 2024, it is expected that 75% of businesses will have deployed multiple data hubs to drive business-critical data and analytics sharing and governance, and 69% of daily managerial operations will be entirely automated.

2. Advanced Risk Management

Risk management has always constituted the core of financial intelligence. In yesteryears, it predominantly involved a reactive approach within financial intelligence solutions. Businesses would identify risks as they surfaced, often culminating in substantial losses. However, the evolution of advanced risk management within financial intelligence solutions promises a paradigm shift.

In the months leading up to 2024, predictive analytics and real-time monitoring seamlessly incorporated into financial intelligence solutions are poised to anticipate potential risks before they escalate. These advanced risk management features embedded within the system will not only detect risks but also offer recommendations for effective mitigation, providing decision-makers with a clear roadmap.

3. Enhanced Data Visualization

Financial data often resembles a complex web of numbers and spreadsheets, challenging decision-makers to extract meaningful insights. However, the trend toward enriched data visualization using top-notch financial intelligence solutions promises a transformative experience.

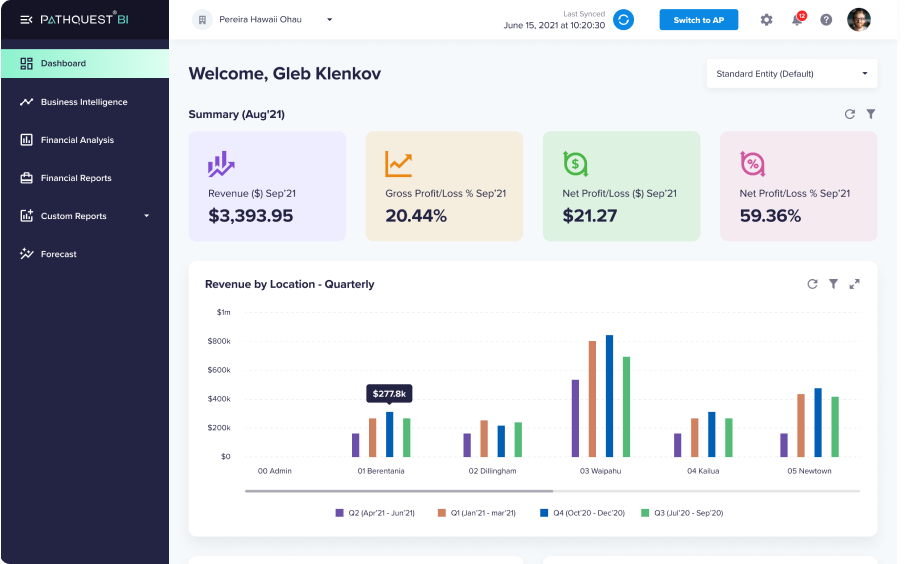

In 2024, we can anticipate a revolution! Dynamic and interactive dashboards integrated seamlessly into financial intelligence solutions will metamorphose complex financial data into captivating visual narratives. These customizable dashboards empower users to delve into specific data points, scrutinize historical trends, and simulate “what-if” scenarios within their financial intelligence solutions, thereby enabling more informed decision-making.

Source: PathQuest BI Dashboard

4. User-Centric Design

Financial intelligence solutions catered primarily to experts, leaving non-financial professionals bewildered by the complexity of the data. However, in the coming year, the emphasis on user-centric design within these solutions promises greater inclusivity. Intuitive interfaces in financial intelligence solutions will empower all users, even those without financial expertise, to navigate effortlessly. These interfaces prioritize user experience, offering guided tours, context-sensitive assistance, and personalized recommendations based on user roles and preferences.

5. Enhanced Mobile Accessibility

Feature-rich mobile applications guarantee that gaining real-time financial reporting for multiple groups, entities, and locations is at your fingertips, empowering decision-makers to act swiftly. These mobile applications are not only expected to offer access to financial data but also sync unlimited financials seamlessly, making them indispensable tools for executives in constant motion.

Take the case of a retail chain that harnessed the power of mobile accessibility to generate real-time financial reports during a critical holiday season. This enabled them to make pricing adjustments on the fly, resulting in a 20% revenue increase.

6. Seamless Data Integration

Data integration has always been a challenge within the financial world, often leading to fragmented insights. Nevertheless, the trend towards seamless data integration within financial intelligence solutions is bridging these disparities. This latest trend employs machine learning algorithms to automatically reconcile diverse data sources, ensuring data precision and consistency throughout the financial intelligence solution.

7. Sustainability Insights

The significance of sustainability in business has been on a steady rise. In the past, comprehending the environmental and social impacts of financial decisions posed a challenge. However, financial intelligence solutions in 2024 promise to bridge this gap. These solutions are expected to provide profound insights into the environmental and social implications of financial decisions, empowering businesses to make responsible choices. This trend will furnish a comprehensive view of sustainability metrics, allowing organizations to monitor and gauge their progress toward sustainability objectives.

8. Artificial Intelligence (AI)

Artificial intelligence (AI) has perpetually driven progress and continues to gain significance. Earlier, AI within financial intelligence solutions played a secondary role. However, in 2024, AI is poised to be the primary driver of insights. AI-driven trends include robust anti-money laundering (AML) and fraud detection systems, reducing fraudulent activities by 50%. Additionally, AI-powered robo-advisory services provide personalized investment recommendations, chatbots streamline customer service, and customer recommendations improve satisfaction. AI empowers financial intelligence solutions, shaping a proactive and efficient financial future.

9. Blockchain Integration

Blockchain technology has garnered recognition for its unmatched security attributes. In 2024, blockchain is primed to provide unparalleled security for financial data present within financial intelligence solutions. The immutable ledger inherent to blockchain substantially reduces the risk of fraud and guarantees data accuracy. These blockchain finance solutions will establish an inviolable audit trail for transactions, ensuring transparency and trust.

Embrace the Future

In the fast-evolving world of finance, the trends we’ve explored are your ticket to success in 2024 and beyond. Don’t hesitate – be a trailblazer. Be ready to incorporate advanced data visualization, predictive analytics, AI, and blockchain into your financial intelligence solutions. By doing so, you’ll unlock the power to make smarter decisions, secure your finances, and deliver unparalleled customer experiences.

The future beckons – will you answer the call?

Contact Us

Call Now:

+1 (743) 223-2073