Contents

Recently updated on December 4th, 2024 at 09:17 am

Imagine, you are in the world where you buy groceries, but instead of cash or credit cards, you exchange food grains or chicken.

Seems absolutely crazy, – right?

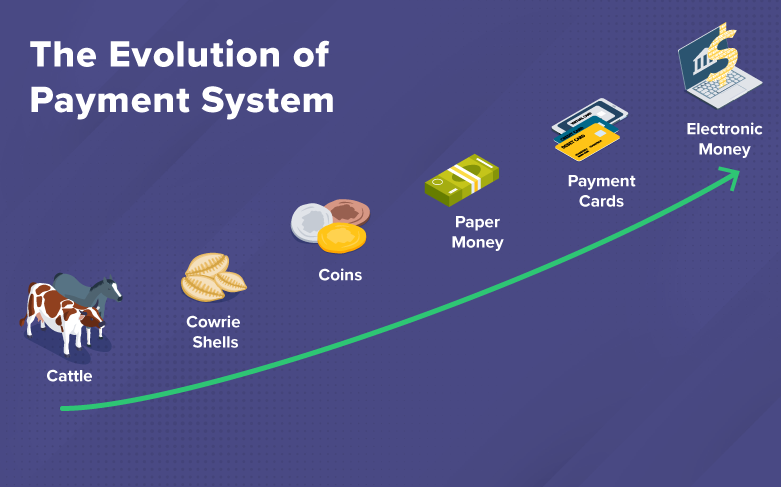

Of course, we have come a long way and have experienced significant changes in the payment methods. Now, we have many choices to make payments such as cash, plastic cards, ACH, check and mobile payment.

Payment methods have seen tremendous transformation over the last 10,000 years. We have used barter methods, coins, paper notes, check, and e-payment these days. Let’s explore this transformation journey.

Barter Methods – The First Form of Payment

Introduced by Mesopotamia Tribes in 6000 BC, barter methods were adopted in different forms by Phoenicians, Babylonians, Romans, Europeans and Colonial Americans.

Phoenicians adopted barter system and started exchanging goods to various cities across oceans. Babylonians brought improvement in this system and started exchanging food, spices, weapons, and salt.

Roman soldiers’ salaries were paid with the most valuable salt. While traveling across the globe, Europeans started exchanging silk and perfumes with crafts and furs. Colonial Americans also adopted bartering with exchange of musket balls, deer skins, and wheat. But bartering system was not scalable and had its own limitations.

Double coincidence of wants was very unusual. It was unlikely to find someone having the exact need of goods or services. There was no common unit to measure the real value. Moreover, it was impossible to divide certain products, like shoes, animals, furniture, and more… This generated the need for the invention of common currency.

Better than Barter – Cowrie Shells, Metal Coins, & Modern Coinage

Cowrie Shells available in the Pacific and Indian Ocean were used as money. Cowrie Shells were introduced in China around 1200 B.C., the adoption of Cowries was found in some parts of Africa, Europe, Asia, and Australia. Gradually, Cowrie Shells emerged as the most widely accepted currency in the history.

Cowrie Shells were modified to Mesopotamian shekel and bronze & copper cowries during Zhou dynasty, the earliest forms of metal coins. The appearance of bronze and copper cowries was distinct in China, India, and cities around the Aegean Sea.

Lydians and Lonia used stamped silver and gold coins, creating a standard of value that could be easily recognized and accepted by traders. Greek coins during the Hellenistic period were spreading culture with currency across large parts of the known world. Wide range of gold and silver Greek coins, having the most bearing a portrait of their patron god or goddess or a legend on one side and a symbol of the city on the other.

Soon, all countries began minting their own series of coins with a designated value. However, in large commercial transactions, metal coins were very bulky to carry, thereby leading to the invention of lighter to carry currencies – paper notes.

Representative Money – Paper Currency & Non-Precious Coinage

China led the way for introducing paper currency in Tang dynasty, today popular as promissory notes. After several centuries, during the Song dynasty, there was a shift from paper receipts to paper money. Jiaozi, the first paper money, was officially printed and issued during the 11th century due to shortage of copper. However, the economic advantages of printing and issuing paper currency or banknotes became apparent.

Want to Shift from Manual to Automation?

Discover tailored solutions with cutting-edge features to start your success journey.

Get StartedThe problems like distrust, currency war and volatility emerged with the invention of paper currency. Many country leaders attempted to devalue their currency and issue it at free will as paper currency had no intrinsic value. The ability to trade internationally for new goods was also enhanced, bringing opportunities for economic growth. After the mid-15th century, non-precious coins once again became the most popular form of payment across the world.

The Rise of Banks and Financial Institutions

Around 1800 B.C., Babylon established the first bank that offered loans and accepted deposits from citizens. In Greece and Rome, moneylenders operated banks that issued loans and accepted deposits. But with collapse of Roman Empire, these banks disappeared. In 1661, Sweden’s Stockholms Banco became the first central bank to attempt to issue banknotes, however, Stockholms became bankrupt in 1694 and was changed to the Bank of England. By 1745, standardized printed notes ranging from £20 to £1,000 were being printed.

Gradually, the sole control of money supply was with the Bank of England. Gold was made the standard of value for printing new notes, and hence, there was a restriction on printing banknotes. By 1900, the US also followed the gold standard, which ended in the 1930s due to devaluation of gold. From 1920s, Merchant banks came into power for loans and corporate finance.

With the rise of banks and financial institutions, the way of payment changed once again. They made it much easier to carry and transfer large amounts of money. Also, it enabled seamless lending and borrowing of money.

Cashless Revolution – The Advent of Plastic Cards and Electronic Payments

Plastic Cards – Today, money has taken the form of everything from cash, plastic cards to ACH and check payments.

Credit and debit cards are the top choices for payment in the US due to the convenience they offer. This made it possible for people to buy things they couldn’t afford. And it also made it easier for businesses to sell goods and services.

Credit was in existence since ages, but universal credit card was introduced in the US during the 1920s, according to Britannica. From the first issuance of Credit cards, individual firms, such as oil companies and hotel chains, began issuing them to customers for purchases made at company outlets.

In 1958, American Express introduced the first widely accepted credit card, and by the end of the decade, Bank of America had introduced the first mass-produced credit card, the BankAmericard, which later became Visa.

Nearly one in four millennials (24%) think that their credit card is a status symbol – Source – lendedu

E-Payments – The debut of electronic payments by Western Union with EFT in 1871, there’s no requirement for physical presence to make payments. However, people became more reliant on e-payments through computer after 1970s.

In 1972, the development of Automated Clearing House (ACH) made processing large volumes of transactions seamless greatly expanding the reach and scope of commerce, and it also made it easier for businesses to sell goods and services.

Undoubtedly, technology has been a driving force, allowing to make payments in a few clicks through laptop, tab, or smartphone. There’s a drastic transformation from 1870 to till date for streamlining payment methods and accounts payable processes with accuracy and efficiency.

“Consumers expect a safe, convenient, and affordable globalised payment platform” – Lucy Peng

Now, not only payments but invoice processing is largely moved from manual and paper-based process to online. Thanks to the continuous advancement in accounts payable solutions, businesses are seamlessly handling countless invoices with minimal human intervention. Businesses have better control and visibility over expenses while getting rid of late, duplicate, and fraudulent payments.

With growing volumes of invoices and financial transaction, a smart accounts payable automation solution is the need of the hour. Gear up to future-proof your accounts payable workflow with PathQuest!

Are you ready to transform manual accounts payable processes? Free Trial!

Want to Shift from Manual to Automation?

Discover tailored solutions with cutting-edge features to start your success journey.

Get StartedContact Us

Call Now:

+1 (743) 223-2073